Dairy Queen

Dairy Queen was once a favorite for ice cream lovers, but it has since experienced a serious decrease in customers, leading to financial concerns. In fact, over the past few years, it has been forced to close various locations, notably in Illinois and Florida. One location in Florida has been a staple for locals for over 60 years but has suffered consistent financial losses due to the opening of other, more popular dessert stores.

A few of the other branches have cited disputes with BRK as the main reason for their closing. While Dairy Queen is still a favorite for many, it simply isn’t anywhere near as popular as it once was.

The Gap

Along with hundreds of other clothing stores, The Gap is trying to navigate the tumultuous ‘retail apocalypse’. However, unlike other brands, they aren’t going down without a fight. In fact, they decided to hire the president of Mattel (the major toy company) as their new CEO, hoping that he would be able to make the necessary changes to stay relevant in such a competitive market. Unfortunately, they were still forced to make a few tough decisions.

Currently, the brand is closing over 200 stores across the country. This will significantly reduce its physical retail footprint, all in a bid to adapt to the changing commercial landscape.

Party City

Party City has faced several challenges in recent years. However, it is still hanging tough, even though it has been forced to close several stores across the country due to its ongoing struggles within the retail landscape. To be more specific, it has closed 22 stores nationwide. Many believe that its financial troubles are a direct result of the online shopping market, which has stunted the growth of various retail stores.

Unfortunately, it is expected that Party City will file for bankruptcy in the coming years as they continue to make financial losses.

WeWork

WeWork was once valued at a whopping $47 billion. However, in recent years, its financial records have shown that the major brand is now only worth about $270 million, indicating significant losses. As a result, a number of locations will close across the country, though it is unknown exactly how many. The company's financial predicament is due to a botched IPO that highlighted its financial instability and leadership turmoil.

On top of this, the departure of former CEO Adam Neuman left the company with a hefty payout debt and poor reputation, contributing to their financial troubles.

Best Buy

Best Buy has made a valiant effort to remain relevant in a competitive market. However, even though it has made significant progress, it has still been forced to close several locations across the country. This year alone, 20 Best Buy branches closed their doors to customers, and more shutdowns are expected in the near future. To save money, it has also decided to replace a few of its larger stores with smaller outlet alternatives.

This pivot is a part of the company's annual strategy, which usually involves the closure of 15 to 20 stores upon lease evaluations.

Lidl

Lidl is one of the most successful supermarket chains in the world. With its roots in America and the UK, the company boasts a net value of over $11 billion. However, despite its financial success, the Lidl CEO has voiced a few concerns regarding inflation and the rise of digital marketplaces. So, in a strategic move, they have decided to close 11 of their poorest-performing locations across the country.

This closure will affect various states, including Virginia, North Carolina, Pennsylvania, Maryland, South Carolina, and New Jersey. Despite these closures, the company continues to show impressive growth in profits.

Big Lots

Big Lots is a prominent discount retailer that most of us have heard of. However, they have undergone a comprehensive transformation in recent years. In a strategic move, they have decided to leave the urban setting for smaller, more rural locations, resulting in the closure of 7 branches across the country. This is in an effort to renew the brand's market presence and expose the company to more clientele in their target audience.

The closures included 4 stores in Colorado and 3 in California. The company has also faced a few financial challenges and hopes that this change will herald a significant turnaround.

TGI Friday's

The first TGI Friday opened in the 1960s. Since then, it has been a popular social venue. However, following the 2020 Pandemic, the company faced several financial challenges. It underwent a significant reduction and was forced to close roughly 20% of its outlets in a single year. Currently, there are 289 locations still in operation across the country. With that being said, they are expected to announce the closure of several other venues, mainly in the Southern states.

However, despite these setbacks, they are hoping to make a comeback by launching new establishments in parts of Asia.

Amazon

Cue the gasps of shock! Amazon is, without a doubt, the most successful company ever. With its trillion-dollar valuation, it is a blue-chip stock. Even so, it has shown that it is not immune to strategic adjustments. In the past few years, Amazon has closed nine of its Amazon Go locations, including four in San Francisco, three in Seattle, and two in New York. These closures raised a number of questions about the popularity of its physical store presence.

However, Amazon is still very successful in the world of online shopping. While it has the finances to continue developing the Amazon Go initiative, many believe that it will instead shift its focus back to e-commerce.

Walmart

Walmart is arguably the biggest and most successful shopping franchise in the United States. With a current business value of around $433 billion, it does come as quite a surprise that they are closing 22 separate branches across the country. This includes four in Chicago and one in Virginia. According to the CEO, this comes as a result of the lackluster performance of these particular branches, all of which failed to meet the varying financial expectations.

In particular, the Chicago branches seemed to struggle the most, with four locations closing due to annual financial losses in the tens of millions.

Steak ‘n Shake

Steak ‘n Shake was once a highly successful company. However, in recent years, they have experienced a severe financial decline. The current value of the business stands at $150 million, leading to the closure of 24 stores across the country. Predominantly found in the Midwest, this once-popular burger joint has seen its reputation dwindle as a result of customer service issues and subpar food quality. Industry giants, such as McDonald’s and Burger King, have also made it difficult for Steak ‘n Shake to stay relevant.

In 2021, the company hit rock bottom and signed a bankruptcy declaration. Since then, more and more stores have been closing their doors every year.

Bed Bath and Beyond

Bed Bath and Beyond was once a household name in home renovations and for all things bed, bath, and - you guessed it - beyond. In fact, it was considered a serious rival to industry giants such as Target. However, in 2023, with a total business value of just $21 million, the company announced its bankruptcy. As a result, 896 stores were shut down, marking the end of a legacy and an unforgettable moment in retail history.

While some outlets offered final sales, others simply ceased operations. Instead, an online company called Overstock acquired all of the remaining assets and continued sales in the digital realm.

JCPenny

JCPenny has always been a notable department store. However, in recent years, it has faced significant financial challenges, leading to the closure of several locations across the country. These include one branch in Elkhart, Indiana, and another in Oswego, New York. Unfortunately, these closures are believed to be just the tip of the iceberg for the company, as JCPenny has experienced a massive decline in sales since 2020. In fact, the company stopped posting its financial records.

This led many to believe that it was struggling more than it was letting on. On the other hand, direct competitors, such as Kohl's, are experiencing growth, which could be contributing to its losses.

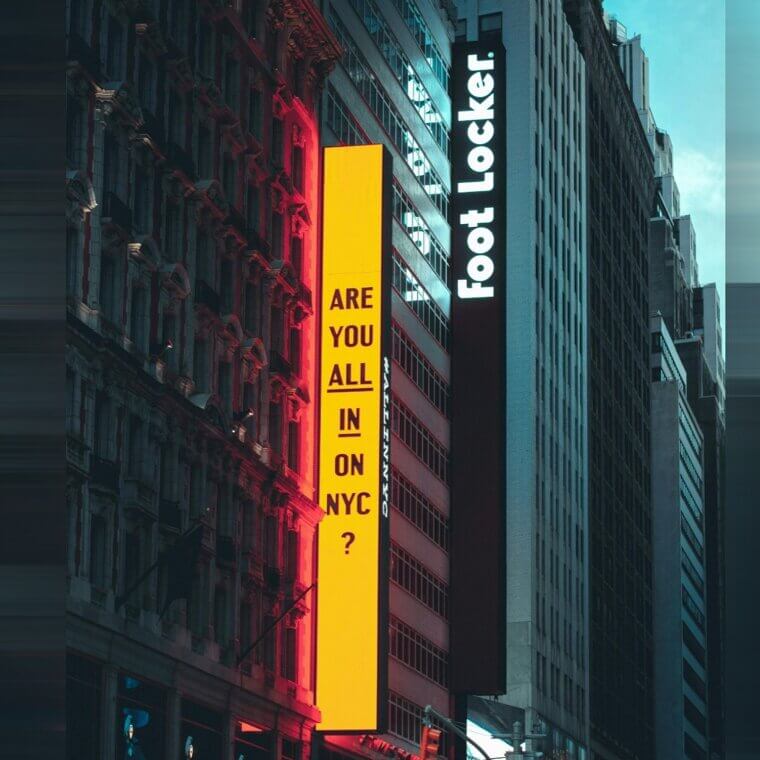

Foot Locker

In the next few years, Foot Locker is set to shut down 545 separate stores, all as a part of a strategic ‘reset’ of its operations. The goal is to close 420 Foot Locker stores and an additional 125 Champs Sports outlets in order to streamline their retail presence. However, they also plan to open 300 new concept stores, both inside shopping malls and at varying factory locations across the country.

Even though Foot Locker isn’t exactly shutting down as a company, it will undergo a complete revamp. Many see this as a smart move, as Foot Locker is finding ways to stay relevant in an ever-changing market.

Hardee’s Fast Food Chain

Hardee’s Fast Food Chain is yet another once-popular restaurant that recently filed for bankruptcy. The chain, owned by Summit Restaurant Holdings, used to be particularly popular in the South. However, it has since announced the closure of 39 locations across the country. With a current business value of $33.15 billion, it simply no longer has the means to continue operations. The chain once boasted over 145 well-frequented outlets nationwide.

However, following the Covid pandemic, they slowly started to lose their customer base and suffer from financial issues. Their downfall is also related to the rise of other major fast food chains, such as McDonald’s, Burger King, and KFC.

Starbucks

Starbucks is, without a doubt, the most successful and popular coffee company in the world. With a total business value of over $115 billion, it came as somewhat of a surprise when they announced that they would be closing down 18 locations across the United States. This figure was initially only supposed to be 16, but they later revised their numbers. Unsurprisingly, this reduction would significantly reduce their physical presence, leaving loyal customers even more shocked by the decision. More so, these closures took place in a few major cities, such as Philadelphia, Seattle, Washington D.C., Portland, and Los Angeles.

The reason for this decision is perhaps the most surprising (and concerning) of all. The CEO cited ‘safety issues’ as the main cause, spurred on by troubling events that put the safety and well-being of employees and patrons at risk.

Walgreens

Walgreens has always been a pharmaceutical staple in the US and UK. However, in recent years, the company has faced a few significant changes that will impact many. They announced the shocking closure of 450 separate stores globally, including 150 locations in the US and 300 in the UK. Understandably, this caused a fair amount of concern among loyal customers, who thought that the brand may close down altogether.

Nobody knows exactly why these changes are being made, but it is safe to assume that they are for financial reasons. Luckily, there are still close to 9000 Walgreens locations in the US alone.

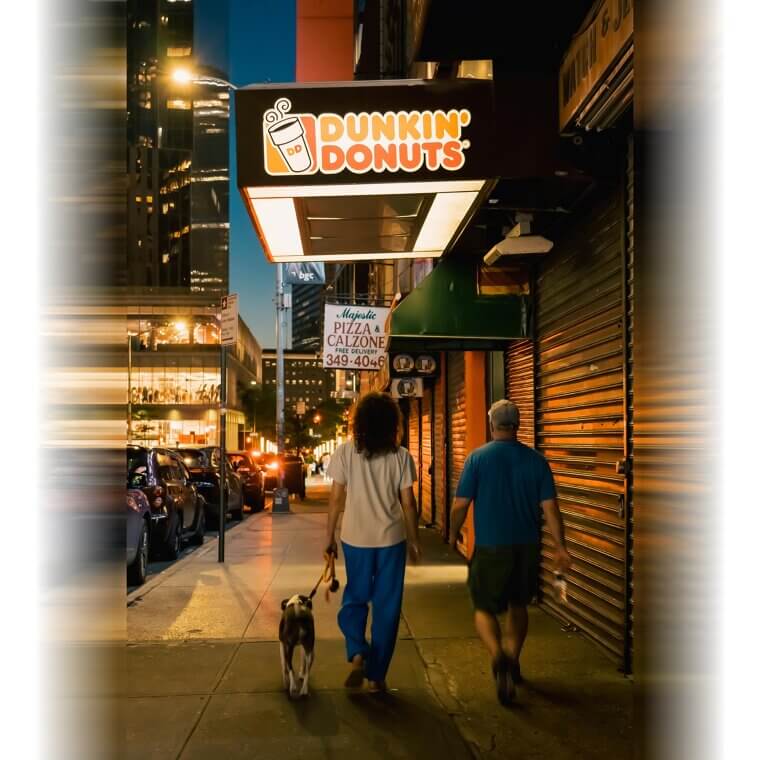

Dunkin’ Donuts

Dunkin’ Donuts was once loved for its coffee, other hot drinks, and delicious donuts. In fact, the franchise specifically thrived in Speedway gas stations, providing motorists with a quick and convenient snack for on the road. However, following the 2020 pandemic, they announced that all Speedway locations would permanently shut down, marking the end of an era. Since then, the franchise has slowly but surely lost its loyal customer base.

This decision followed the end of Dunkin’s long-time partnership with Speedway, which ended all joint operations. The process was expedited, ensuring that all locations would cease operations before the end of the year.

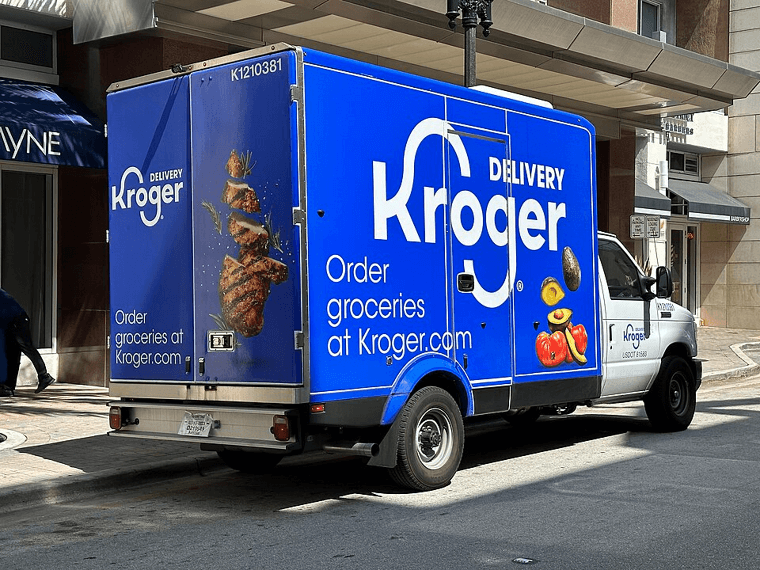

Kroger

It may be surprising, but Kroger actually stands as the top supermarket chain in the United States. With a current business value of over $35 billion, they have had a more than successful run since their inception. With that being said, the CEO recently announced the closure of 2 separate locations across the country. With more closures expected to take place in the future, this strategic move signifies the company's willingness to adapt to an ever-evolving market. The 2 locations that have already shut down were both located in Ohio (Kroger’s base state).

Luckily, loyal Kroger customers can rest assured that the supermarket chain is not going anywhere. In fact, the closure of these smaller stores will make room in the budget for the opening of larger, more centrally located ones.

Red Lobster

Red Lobster was first established in 1968 and, throughout the years, has become somewhat of a household name. The company has catered to seafood lovers across the country, and it is popular for its famous cheddar bay biscuits, shrimp platters, and lobster - all sold at affordable prices. Unfortunately, they have faced a number of financial challenges in recent years, leading to the closure of 13 stores. However, this hasn’t only been the trend in America. Once boasting over 700 stores across the globe, Red Lobster’s physical presence has slowly dwindled, with dozens of branches closing each year.

These closures highlight the fact that the company is struggling to maintain its once-vast empire. After all, the dining industry is constantly evolving, making it difficult for older franchises to stay relevant.

Bath and Body Works

Bath and Body Works is one of the most popular stores in every mall across the country. In fact, just a few years ago, it was in the financial position to undergo a massive expansion, with close to 90 new stores opening nationwide. It was also on a mission to rejuvenate its brand, which led to the remodeling of 25 more stores. However, due to this reshuffling and the additional financial burden, it was forced to close 50 of its least popular locations.

Unlike many of the brands on our list, Bath and Body Works is still very popular and financially stable. It has also found a way to stay relevant in the competitive health and beauty market.

Outback Steakhouse

Outback Steakhouse was once one of the most popular restaurant chains in the country. Unfortunately, following the 2020 pandemic, many branches were forced to shut down for financial reasons. 5 years down the line, they still seem to be struggling with low patronage, as they recently announced the closure of 3 additional locations. While loyal customers may miss the famed Bloomin’ Onions in some locations (including Hawaii and Massachusetts), there are also reports that a massive overhaul is in the works.

In a bid to rejuvenate the business, they have developed a plan to launch between 75 and 100 new locations across the country within the next few years. With a current business value of over $2.2 billion, they still have the necessary funds in order to pull off such an ambitious expansion.

Cracker Barrel

In recent years, records have shown a significant decrease in patronage at the Cracker Barrel. As a result, this once-popular restaurant franchise has been forced to close down a number of locations, especially in the southern states. Last year, a total of 3 branches shut their doors in Oregon alone. These locations had been performing particularly badly, leading to annual losses in revenue. The dining industry is constantly evolving, making it difficult for older restaurants to stay relevant. With the opening of new franchises, Cracker Barrel simply has not been able to keep up with modern trends.

Additionally, the CEO of Cracker Barrel attributes these closures to the 2020 pandemic, claiming that they simply were not able to recover from the financial loss, as well as the loss in customers.

Target

It seems strange that Target would be on our list, as it is one of the most popular franchises in the country. However, despite its popularity, the company isn’t immune to strategic adjustments. Last year, four of its branches in major cities closed down, which left the public rather surprised. These included two stores in Washington, D.C., one in Minneapolis and another in Philadelphia. Don’t worry, though, because Target isn’t going anywhere!

In fact, the retail giant has plans to open 20 new stores across the country. It’s safe to assume that they strategically closed down a few of their least popular locations in order to spend the saved money on this new project.

Macy’s

In the past decade, Macy’s has experienced a rather shocking decline in sales, forcing the company to close several stores. However, the company remains afloat, with net sales reaching roughly $8.5 billion in the past quarter. Certain branches did not perform well, with four in particular suffering a 5% loss in sales compared to previous years. As a result, the company decided to close these locations for financial reasons.

To be more specific, they shut down 4 flagship stores located in Maryland, Hawaii, Colorado, and California. They have also announced a strategic plan to shut down a further 125 locations in the coming years.

David’s Bridal

David’s Bridal is a beloved formalwear and wedding dress shop in America. However, in the past decade, they have faced bankruptcy twice, underscoring the retailer's financial struggles amidst its popularity. As a result, they have been forced to close a number of locations across the country. While it is unknown exactly how many stores have closed their doors to the public, we do know that the number increases every year. However, towards the end of last year, the franchise was somewhat rescued by Cion Investment Corp.

They expect that this change in management will lead to operational streamlining and a financial resurgence. In order for this to happen, though, they will need to look at opening new stores and increasing their physical presence.

Nordstrom

Last year, Cleveland.com reported that both Nordstrom and Nordstrom Rack would be closing a number of locations across America and Canada. This announcement marks a significant shift for the upscale retail giant. By the end of the year, they plan to shut down 2 stores in the US, including 1 in San Francisco, which has been performing particularly badly in recent years. When asked about these closures, Nordstrom cited the evolving dynamics of downtown San Francisco as the main reason for their decision.

With a total business value of close to $4 billion, it’s safe to say that there is no reason for financial concern amongst loyal customers.

Pizza Hut

The past few years have proven to be rather challenging for Pizza Hut. For some reason, the New York branches seem to be struggling the most. As a result, 7 outlets closed their doors in the last year alone, raising alarm amongst loyal locals about the potential of further closures. No clear explanation has been given in regards to the reason behind these closures and why they seem only to be occurring in New York.

The exact locations that shut down included Ballston Spa, Amsterdam, Gloversville, Monticello, Herkimer, Johnstown, and Cobleskill. Despite this, Pizza Hut assured its customers that they were still committed to delivering outstanding service and products.

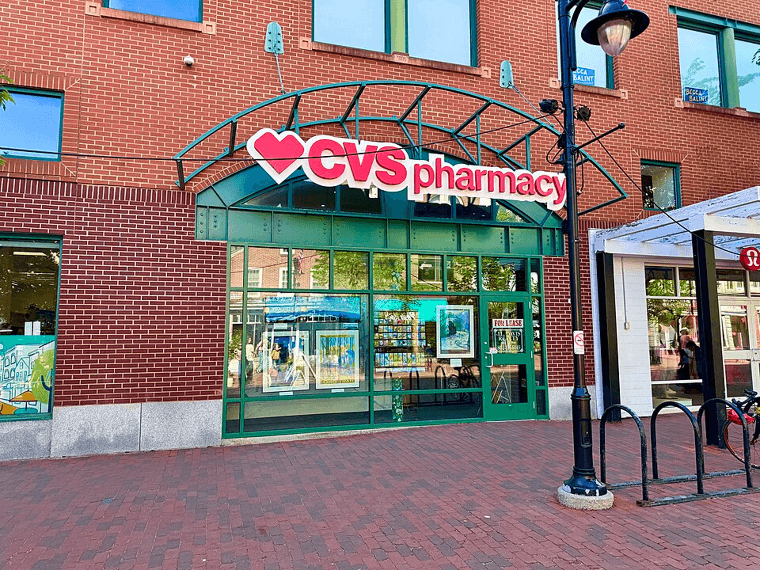

CVS

CVS was once considered the most successful pharmaceutical retailer in the country. In fact, it was hard to drive through a suburb without encountering a CVS pharmacy on a street corner. However, a few years ago, they announced that they would be closing all locations across the US, with the plan to shut down completely by 2026. This includes over 900 stores, some of which have served their respective communities for decades.

Since then, CVS has slowly started phasing out stores, attributing their closure to the rise of digital shopping trends and a rapid downturn in in-store sales. This seems to be the main cause of closure for many retail companies.

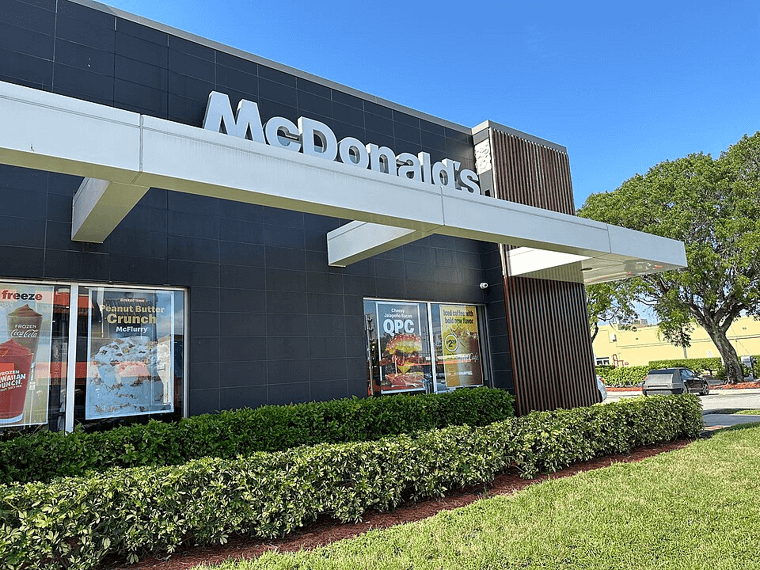

McDonald’s

McDonald’s is by far the world’s most successful and popular fast food chain. With a total business value of over $210 billion, it came as a bit of a surprise when it announced that it would be closing various locations as part of a significant overhaul. This included one major branch in Pittsburgh. In addition, it has made a number of layoffs in its restructuring effort, leaving tens of thousands of former employees without a job.

According to the Post-Gazette, the closure of these locations can be attributed to diminished drive-through patronage, which led to lease non-renewal. This could be due to the increased popularity of food delivery services, such as Uber Eats.

Buy Buy Baby

Buy Buy Baby is a subsidiary of Bed Bath and Beyond, another company that was forced to close various locations as a result of financial collapse. At one stage, Buy Buy Baby was one of the more popular stores for all things baby. With a business value of just $15 million, Buy Buy Baby filed for bankruptcy before being purchased by Dream on Me, a company that specializes in the sale of baby and toddler products.

Despite the hope that this new ownership would revive the company, Dream on Me recently announced that 120 locations would still close nationwide. BBB will mark the end of its retail presence with significant sales.

The RealReal

If you are interested in high-end fashion, you have probably heard of The RealReal. The company was launched in 2011, and the platform specializes in reselling pre-owned designer apparel. However, with a current business value of $210 million, it’s safe to say that the company has its fair share of financial issues, especially for an elite resale brand. As a result, it has been forced to shut down four stores nationwide, including two consignment offices.

In order to save money, they have made significant financial adjustments since 2020. The closure of these 4 stores is expected to save them a total of $2 million per year.

Tuesday Morning

Believe it or not, Tuesday Morning will close a whopping 487 locations across the country this year alone. With a current business value of $750 million, the home decor chain has, sadly but unsurprisingly, been experiencing financial issues since 2020. In fact, in the past year alone, it faced a net loss of $59 million. By the end of last year, the chain announced that it would be closing all stores.

This came as a bit of a surprise, as only a few months earlier, they claimed that they would only be forced to close down half of their stores.

Christmas Tree Shops

Christmas Tree Shops, a company known for its festive decorations, declared bankruptcy a few years back. Originating in New England, the company has been forced to close down various locations across the country. To be more specific, they will be shutting down all 82 of their branches, marking the end of an era. The exact reason for their financial predicament is unknown, but that doesn't mean tongues haven't been wagging.

Many believe it is due to increasing interest rates, inflation, and a decrease in demand. Following their bankruptcy announcement, stores have slowly been closing nationwide.

Aldi

Aldi has quickly become one of the country’s fastest-growing supermarket chains. Known for their affordable prices and wide selection, it’s no surprise that the German-based brand has become such a hit amongst Americans. Despite their impressive growth in the past few years, Aldi has been forced to shut down one location. Located in Pittsburgh, the closure of the ever-popular Lower Burrell branch shocked a lot of residents, including loyal customers. However, this shock was quickly replaced with excitement, as a new, larger store was opened in New Kensington.

In 2022 alone, Aldi opened 9 new stores across the country. It’s safe to say that the company isn’t showing any signs of slowing down, with more and more families choosing Aldi as their everyday supermarket.

Sprouts Farmers Market

Sprouts Farmers Market is a rapidly expanding grocery chain. In fact, they have become so popular in recent years that the CEO announced an ambitious plan to open 30 new locations across the country. With that being said, they will have to make a few closures in order to make the necessary room in their budget. As a result, 11 locations will be shut down, marking the first step in their strategic plan for additional growth. They specifically selected 11 of their worst-performing stores nationwide, ensuring that the new locations will still cater to these areas.

More specifically, the company has chosen to move away from large-format stores, which seem to bring in the least money. Instead, it is opting for smaller, more efficient store models. This change also reflects its plan for improved productivity, which was highlighted in a recent statement.

Green Zebra

The three-store Green Zebra grocery chain has served the Portland community for a number of years. In fact, it became so popular amongst locals that many would choose Green Zebra over grocery store giants, such as Safeway and Aldi. However, in 2023, the company announced that they would be closing all 3 stores, leaving loyal customers devastated. These closures marked the end of an era for a brand that had become a household name in Oregon. After more than a decade of selling unique products that couldn’t be found in other stores, Lisa Sedlar (Green Zebra’s CEO) revealed that the company simply was not making enough money to remain in operation.

Like many smaller businesses, Green Zebra was significantly challenged by the 2020 pandemic. Despite its large customer base, it was unable to recover from its financial loss.

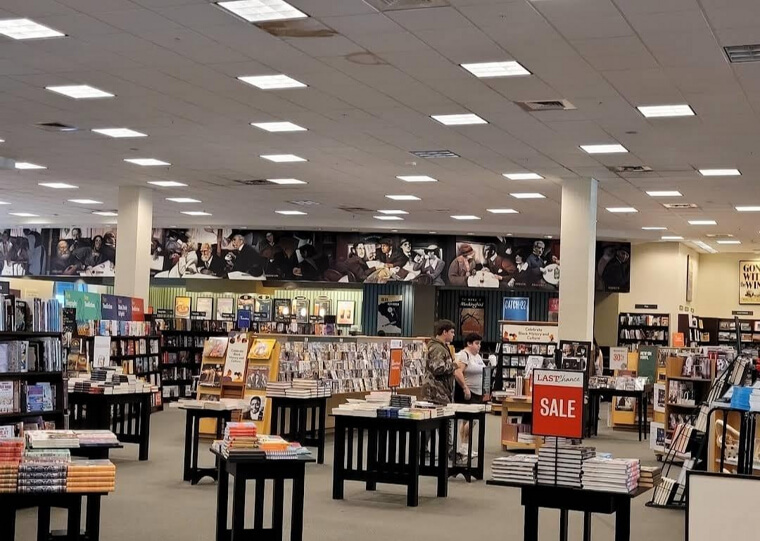

Barnes and Noble

A few years back, Barnes and Noble operated about 600 stores across the country. However, following the pandemic, they announced the closure of 2 major locations in Sacramento, California. Then, just a few months later, they revealed that they would be closing an additional 10 locations - all situated in California. With that being said, loyal customers have reason to believe the future of Barnes and Noble looks a little bit more optimistic despite these major setbacks. In an attempt to expand the business, the CEO announced that they are looking to open 30 new stores across the country.

With a total business value of over $3.5 billion, they still have the financial means to support such an ambitious business plan. More so, this strategic move indicates a positive trajectory for the company’s growth.