When Being Poor Meets Modernity

Being poor nowadays is almost like being part of a club for the financially challenged, where high-speed internet can help you find top-tier recipes, but actually buying food is out of reach. Instagram-worthy smartphones are something that almost everyone has, and most of us would spend every last dime on tech as opposed to the necessities. Who needs electricity and heat when there are internet memes to keep us thoroughly entertained?

This perfectly sums up being broke in an average country- there's no need for a house or a car when you can check your low balance on a fancy laptop.

Some Electric Bills Are Just Too High

Snoop Dog's cool and collected demeanor might show he's not the one to stress over a high electric bill, but we certainly can't all say the same. At least we have Snoop and this meme to help us laugh through the pain of every expense and bill that comes to mind. The one relatable thing about this is that everyone hopes for a low bill, but that often doesn't work in our favor.

This meme of Snoop Dog perfectly represents the pain we all feel when we get our electric bill, which is happily not the kind of high that Snoop Dog worries about.

The Two Kinds of Financial Coin Stackers

The meme here featuring stacks of coins is doing a great job of representing how people organize their finances in real life- and it's hilariously relatable. There's the "organized" stack, where all the coins are arranged in a perfect little pile according to size. Then, there's the "chaotic" stack, where things are thrown together in an order than might not make sense. Those things represent every single financial priority, of course.

Who knew that there's a meme that perfectly represents our inner thoughts when it comes to bill management? But let's be honest, most of us are living the "chaotic" stack life.

That Moment When Free Appliances Are Gold

We all hit a certain age where a free high-powered blender or a top-of-the-line washing machine is worth its weight in gold and can't really compare to anything else. The excitement of winning a prize from a raffle or contest is fantastic, even though a brand-new toaster isn't as glamorous as a free vacation. There's just no denying that a certain amount of joy comes with new appliances in adulthood.

It's true- as we get older and more financially independent, priorities happen to shift from wanting the latest fashion item to being excited about a new kitchen appliance or vacuum cleaner.

Realities of a Checkout Experience

We've all been there, hovering over the "purchase" button, heart racing as you enter your payment information, hoping it's the right card or enough money in the account. There's nothing that relieves that panic more than the moment of truth: the "approved" message popping up. That relief is almost like winning the lottery, except instead of gaining money, you're losing just a little bit- depending on the size of the purchase.

That approval message makes all the momentary stress and panic worth it, plus, you get to go home with something that you just bought after successfully completing the shopping mission.

When Money Is Just a Memory

Some people are strapped for cash, whether it's due to a lack of income or just poor money management. Let's also face the facts- keeping track of every little purchase isn't always as easy. Also, who needs real money when you can reminisce about the good old days when you had some? Baby Yoda might not be a real-life character, but this memory is too real for many of us.

If any meme could capture the essence of budgeting, it would probably be this one, especially since Baby Yoda is saying that there isn't even any money to speak of.

Cars Betray When the Bills Are Paid

As soon as you start to feel like you've got it all together, by tradition, something new often goes wrong. That something normally happens to be the car, where strange noises tend to appear after all the bills are paid. It's almost like your car is jealous of the newfound financial freedom, where treating yourself is suddenly not allowed. At that point, it's time to return to noodles and tap water.

The sense of accomplishment and financial stability is second to none, yet somehow, cars seem to have a sixth sense and love to shut down when all the cash is gone.

A Homeowner's Guide to Working With Burglars

Would a thief be taken back by the request to tag along to find some unknown cash after they break in? Probably. They might give up on the venture and walk back out the front door. Anyone with a ton of money would be worried about a robbery, but those who barely have a dollar to their don't have too much to worry about- and of course, two heads are better than one.

When you're living paycheck to paycheck, every penny counts, and if that means teaming up with a thief to find some unknown cash, well, a bit of cooperation never harmed anyone.

Middle Class Dreams and Inflation Nightmares

This meme hits too close to home for most people, mainly because it's way too accurate. There's certainly a thrill that comes with finally making it to the middle class before inflation slowly sneaks up on you. It does its best to erode any purchases before realizing that nothing is affordable anymore. That's why it's a good thing that memes exist because the average person deserves something to laugh about.

This meme is making its rounds on the internet as it perfectly captures the feeling of financial whiplash that comes with inflation. It's all smiles and grins before getting knocked down a class.

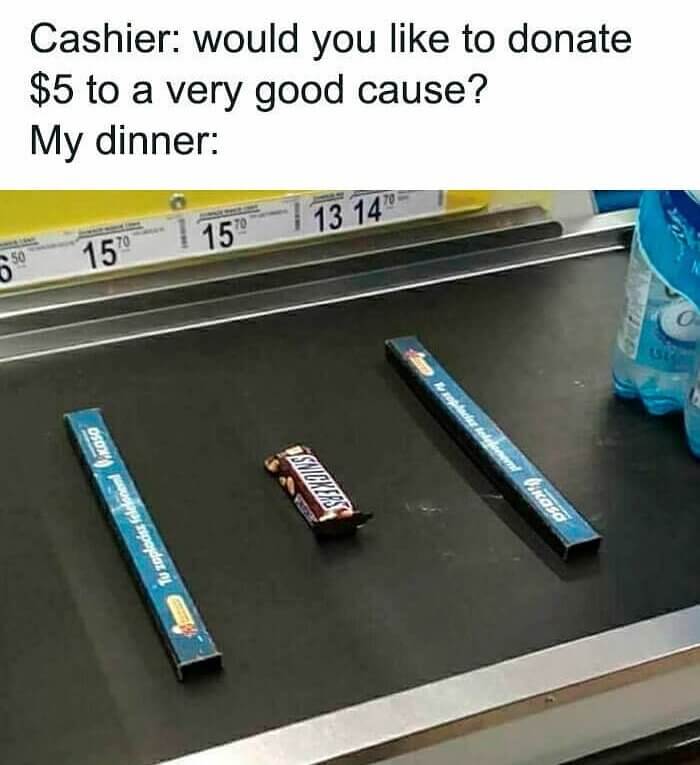

The Famous Checkout Donation Dilemma

Have you ever been in line at the grocery store when the cashier asks if you would like to round up and donate a dollar or two to a charity? It's a common occurrence these days, and the moment is weird if you're also poor yourself. It would be nice if the discount-brand cereal and frozen food on the conveyor belt were enough to convey the message to the cashier.

Needless to say, the question is a little awkward when you're barely scraping by yourself, but what's even more uncomfortable is that moment of silence when you decline to donate.

Costly Gas Prices and The Slow and Furious

It's entirely possible that, at this point, our favorite A-list actors are ditching their luxury rides and hopping on the bus like the rest of us just because gas is so expensive. Of course, quite a few celebrities are immune to the pain at the pump, and we're guessing that Beyonce is doing just fine when it comes to getting around town. Although, keeping those fancy sports cars fueled is no longer cheap.

The Fast and Furious saga made sense for a while, but with the current gas prices, the only kind of people out on the roads are the slow and furious.

Banking on the Digits, Not the Quantity

The truth is, there really aren't magic numbers that can guarantee financial security, although this person would agree that anything higher than $9.11 would be nice. Unfortunately, there also aren't too many phone numbers that look like bank balances unless they're about seven digits long, which certainly isn't the point here. But why not have a bit of fun with what you do have? Especially since worrying about income just simply isn't enjoyable.

Although this might sound like a piece of cute and catchy financial advice, it probably isn't the best idea, but we do appreciate the light-hearted approach to having basically no money.

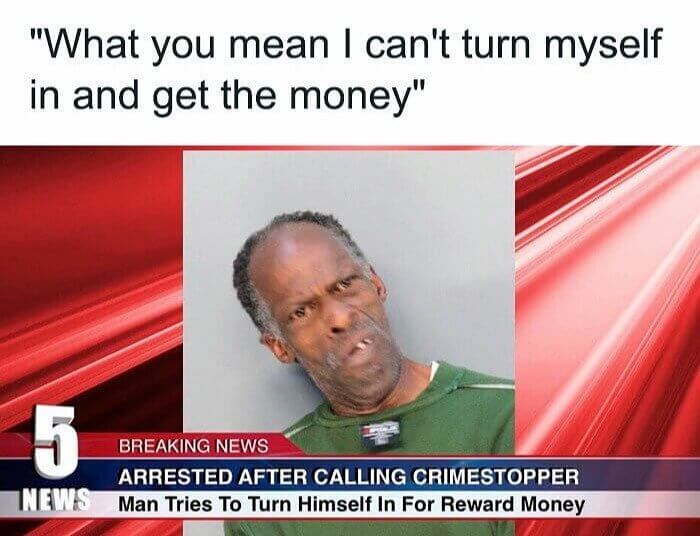

When the Price of Crime Is Too Good

Most people know that turning yourself into the police for a reward isn't the most intelligent strategy, but as you can tell by the picture, this man isn't like most people. The amount of money he was hoping to receive probably wasn't worth the hassle of indefinitely entering the legal system. This meme is an excellent reminder that many people make the most illogical decisions when earning some extra cash.

Some people are so desperate for cash that they'll take drastic measures just to get their hands on a few dollars. This man's plan certainly didn't work out in his favor.

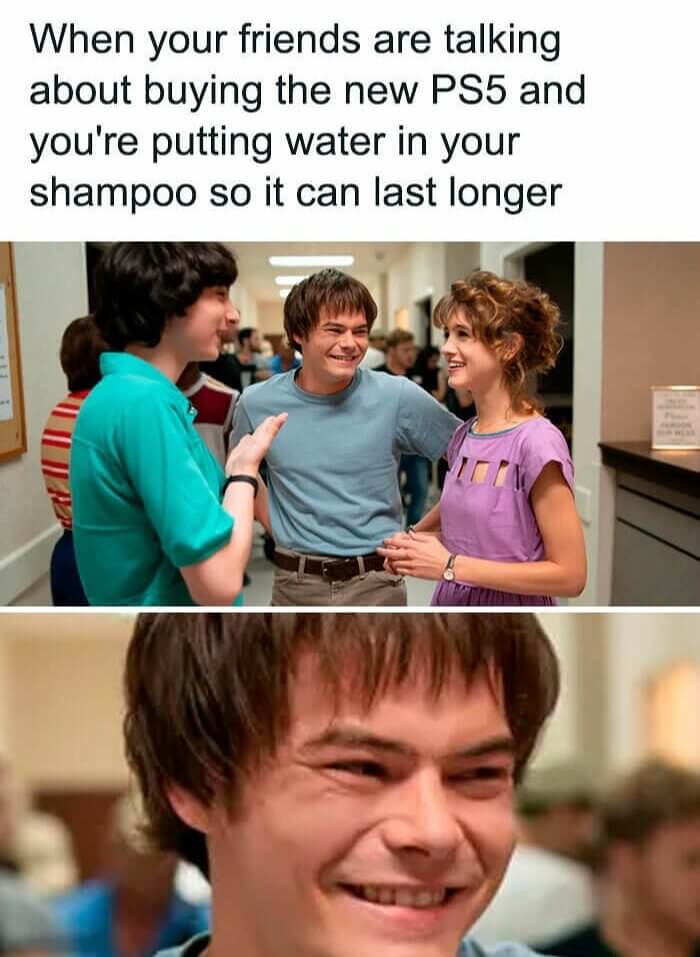

Video Game Dreams and Shampoo Schemes

Admitting that you can't afford the latest tech or trendy fashion could be a bit embarrassing, but there really is something to say about being smart with your money. While you might not need to be a genius to add some water to a shampoo bottle, every drop does count. Some day, those same friends might even ask you for financial advice after they get tired of playing with their brand-new video game console.

What's inevitable is having friends that talk about the latest and greatest gadgets or video games while some of us wonder if we could install that game on our century-old phones.

Why Payday Is the Best Day

Sometimes, payday is all about paying the bills, while other times- it's about having a bit of fun with your hard-earned cash. The only issue is at the end of it; your bank account might be looking slim again after treating yourself to some fancy merchandise. Although, for a brief moment, there really is something to celebrate while possibly even having a little left over for a day of fun because you've earned it.

Payday is the day when you can finally afford more than a single banana, and this monkey can truly understand how good it feels to have more than just one.

When Even Babies Have to Compromise

Babies are undoubtedly the epitome of cuteness and innocence, but based on this meme, they can't always escape the harsh realities of financial limitations. The truth is, kids are expensive, and although there are so many times when you've walked into a store, wanted something, and then put it back because of the price- babies are a permanent commitment. However, there are probably many parents out there who appreciate the suggestion.

The struggle is real when it comes to affording things we want and need, and apparently, it's not only adults who feel the financial pressure; even babies are making a sacrifice.

How to Live on the Edge of Wealth

There's no denying that laptops are expensive, but celebrities with a ton of cash are basically able to buy one whenever they feel like it. That could be what's happening here while the rest of us cradle our laptops like newborn babies. Anything from a cracked screen to a broken keyboard can break the bank, so we certainly don't recommend holding any of your electronic devices as if they're pieces of paper.

There aren't too many of us, famous or not, who are confident enough in our financial security to hold our laptops in a way that could result in a catastrophic drop.

A Bank Account That Loves Surprises

There's nothing better than a surprise, but when it comes from your bank account- it suddenly feels like the epitome of happiness has been achieved. Thinking you have only $5 and then realizing there's over $17 doesn't exactly make you rich, but the world really might suddenly feel like a manageable place for the time being. Hey, that means you could even afford an entire meal as opposed to only half of one- amazing.

Have you ever had the feeling of thinking you're broke, only to realize you're actually not as bad off as you thought? It just makes everything about that day better.

When Bills Were Just a Funny Word

Childhood was a time of innocence, wonder, and not having to worry about any type of bill. Remember those carefree days of playing outside and eating ice cream with about zero other worries? Yeah, we do too. The best part was having to pay for absolutely none of it. As adulthood approaches, the bills keep coming and even seem to pile up faster than ever, but that's not to say that being an adult doesn't have its perks.

After seeing this, it's no wonder why so many people look back on their younger years with fondness and nostalgia. Life was so good and, of course, cheaper than ever.

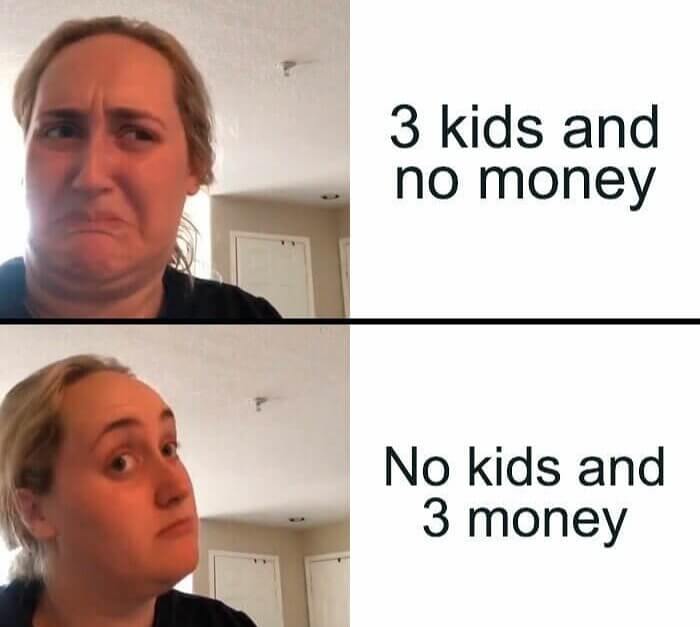

No Kids, 3 Money, No Problem

There are lots of parents out there who are struggling to make ends meet while making sure their kids are always having a good time at every point in life. That's not to say that those same parents aren't daydreaming about what it would be like to have more cash than they do children. After all that work, a bit of imagination is definitely well-earned for people who are raising (very expensive) bundles of joy.

Raising little ones is expensive if you don't already know by now. Between diapers, food, and all those extracurricular activities- having three money is definitely better than having three kids.

When Being Broke Is Also Fashionable

They didn't have the budget to fill this display cabinet with fancy and expensive new plates. The solution? Paper ones. These homeowners took a bunch of the same cheap plates and red cups and neatly arranged them in the cabinet for the world to see. It's a hilarious way to add a pop of style even when the funds are running low, and truthfully, this is kind of inspiring for the rest of us.

Sometimes, being broke means getting creative with how you decorate your home- and that's precisely what this homeowner did when they found themselves in need of filling up a cabinet.

Shopping Isn't Always the Best Medicine

When it comes to emotions, most doctors recommend therapy while also agreeing that shopping isn't exactly the best coping mechanism- but it certainly is fun. In this day and age, you can shop and add things to a cart with the simple touch of a finger on a screen. There are so many coping methods, and while shopping is definitely one of the better ones out there, it can certainly break the bank at some point.

It's tempting to turn to shopping as a way to feel better when we're feeling sad or down, but technically- retail therapy is still a type of therapy, so it works.

Commuting Is Often the Only Affordable Adventure

There's nothing glamorous about the daily commute to work, but there's just something about seeing the world that makes the mundane parts of life worth it. There are so many hard-working people who would like to go on an adventure or two but can't afford the fancy vacation just yet. If that's you, there's no need to give up hope because if you're going to work, well- at least you're going somewhere.

The excitement of exploring new places, trying new foods, and meeting new people is something that everyone wants to experience- but, unfortunately, there is nothing cheap about seeing the world.

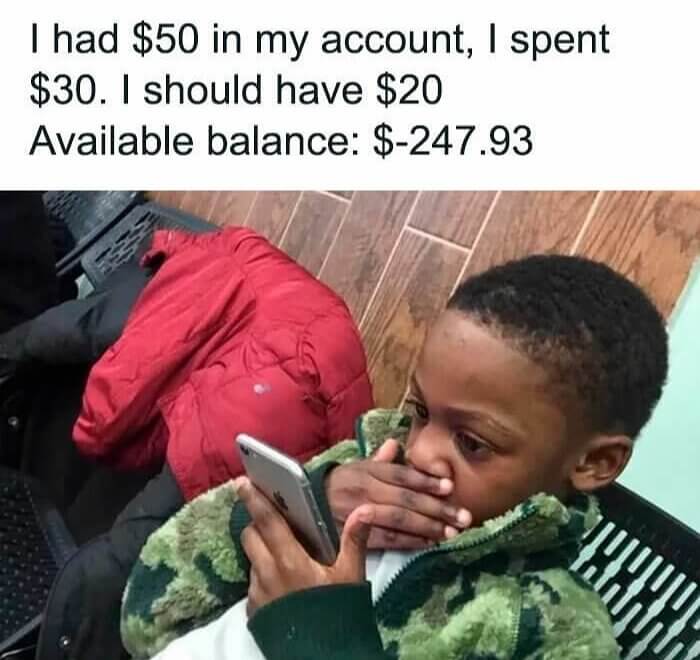

When Money Seems to Mysteriously Disappear

Chances are, you've had the feeling of being rich one minute and then completely broke the next. That's because it's so easy to forget how much you've actually spent. It's almost like our brains are equipped with a money-erasing mechanism that kicks in as soon as we swipe those credit cards or click that "add-to-cart" button. Feeling like you've got a handle on your finances is certainly a good feeling, so it's okay to blame yourself.

Whether you've maxed out your credit or are running behind on student loans, budgeting while keeping track of your expenses isn't always simple, so it's easy to forget what you've bought.

Money Might Be Able To Buy (Some) Happiness

With a billion dollars, you can really buy anything that your heart desires. Whether it's a mansion, a private island, or a collection of expensive cars- the sky is the limit at that point. Of course, there are times when all of us appreciate what we do have, but it's also kind of hard not to think about what we don't. There's no denying that at least a bit of happiness would alongside a billion dollars.

Let's be real; the chances of becoming a billionaire are basically slim to none in the real world. Thankfully, there's no harm in dreaming about all of that fresh cash.

Some Bank Accounts Are on Life Support

This picture of a street lamp hanging on for dear life while still functioning is acting as a pretty good representation of how some people are feeling financially. The problem is, even if you're broke, you still kind of need money to exist just to make life more enjoyable. Of course, you can start getting creative when it comes to extra income, especially since some desperate times call for desperate measures, and this traffic light would agree.

You know you're in trouble when it feels like your bank account starts laughing at you every time you log into the app before choosing to ignore the facts for a while.

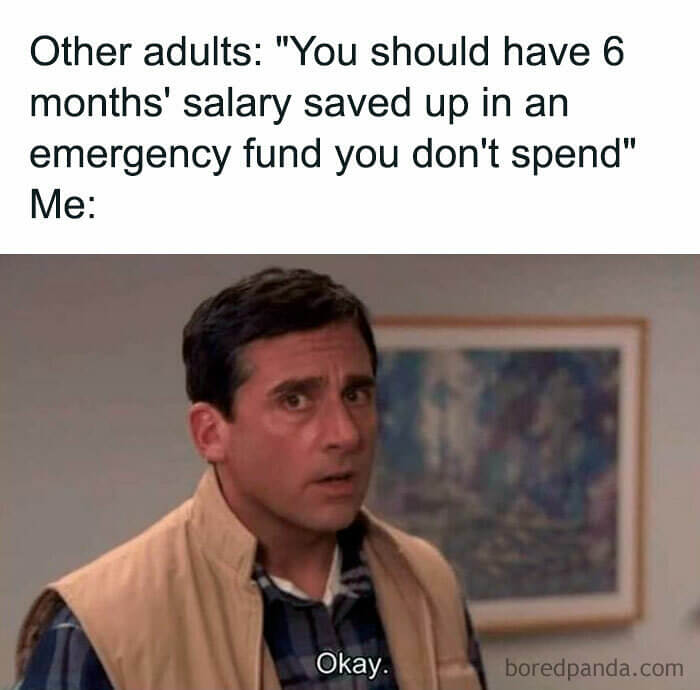

An Emergency Fund or Emergency Fantasy

To all the adults out there who are preaching about the importance of an emergency fund, we hear you. Unfortunately, not too many hard-working people can magically deposit some extra cash in their bank accounts since many of them are living paycheck to paycheck. That's why most of us can only work with what we have, although there isn't anyone who wouldn't want to have an extra six months of financial stability.

This advice is basically the equivalent of eating your vegetables, except the value of extra cash is a lot higher than that of a carrot and probably lasts a lot longer, too.

Millennial Homes, Windows Not Included

Who needs windows when you have student debt the size of a small country? Although windows bring many great things to a home, some of us are too poor to afford them. At this point, as long as there are small enough holes for ventilation, you can live in anything. Some people may not have much disposable income, but that can certainly be made up for with a touch of creativity.

When it comes to houses, among other things, it sometimes seems like millennials can't catch a break. Some people just can't afford a home with this much luxury- meaning windows.

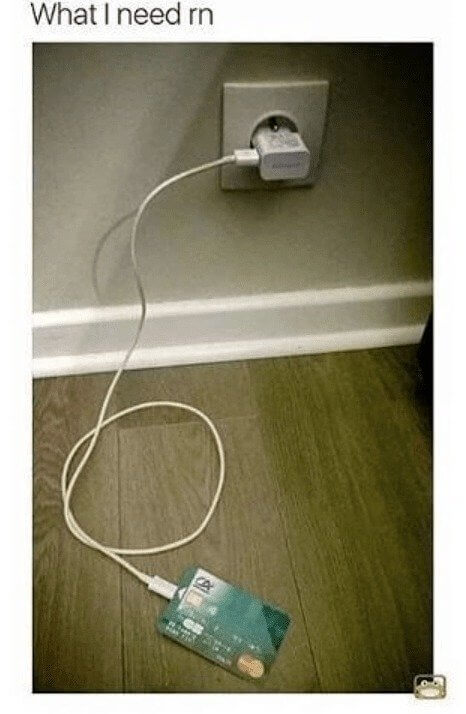

The Unpromising Future of Easy Money Refills

Imagine sitting at a coffee shop, sipping on a hot latte, and noticing that your bank account is nearly zero since you spent your last dime on that cup of coffee. Instead of running to the bank or to work, you could plug your credit card into a charger, filling it back up with cash. Even though this sounds amazing, the economy will never end up working in our favor.

It really would be nice to just plug your credit card into a wall charger and then refill the balance as you do with your phone; unfortunately, we'll have to keep dreaming.

The Bank Account Balance Blues

There's nothing more unfortunate than when you're pretty sure that you have a good amount of money left, only to realize you read the numbers completely wrong. It's basically a punch in the gut from your phone screen, especially if you originally thought there was $200 when there's actually only $2. It really does happen to the best of us, but two bucks is kind of hard to live off of until the next paycheck.

Some people do avoid checking their bank account balance so that they don't have ever to feel disappointed about the very unpromising number that keeps sadly appearing on the screen.

When Work Pays Well but Life Costs More

As soon as things start to be looking up, it really does feel like disaster also chooses to strike. A perfect example of this is finally getting a well-paying job before the economy decides to play a twisted game where suddenly nothing is affordable. You might be tempted to ignore the expensive truth while also making an effort to cut back on those expenses before the next glorious paycheck rolls in.

You might have dreamed of the moment when you've finally landed the perfect high-paying job you've worked so hard for, but as soon as you're settled, gas prices spike through the roof.

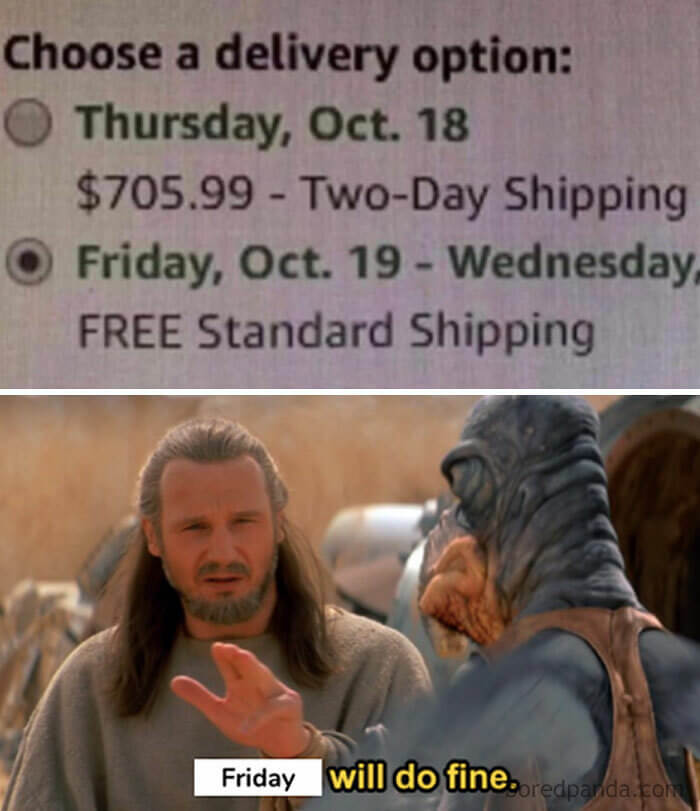

Online Shopping Is a Blessing and a Curse

Some people simply have to go with the longer delivery option while shopping online for no other reason than being poor. Although, and extra $705 just to get something sent a day earlier is even illogical for all the rich shoppers out there. Of course, it's not that we don't want our package to arrive a little bit quicker; it's just that the extra money to pay for express delivery just isn't worth it.

In one way, you can practically buy anything from the comfort of your very own home. In another, you have to deal with deciding what shipping option you're going to choose.

The Struggle of Buying Food That Fails

Sometimes, it's better to stick with those cheap and mediocre meals just to play it safe. Other times, we just want to spend a bit of cash on something that's supposed to taste amazing. It's all fun and games, and things seem promising until you take that first bite, only to realize your ten-dollar sandwich tastes terrible. What comes next is the regret, where all you can think about is how expensive that gross sandwich was.

What's better than spending hard-earned money on a delicious meal? Nothing. Except when the meal isn't delicious, it feels like the world might as well be ending at that point.

Why Self-Care Sometimes Means Debt

Whether you've just bought a fancy latte or splurged on a new outfit at the mall, it's easy to accidentally overspend, regardless of where you're shopping. In fact, you might have done the math wrong and thought you spent $20 when that number was closer to $200 on a certain day out. There's no denying that the joy of shopping can sometimes drown out the fear of debt, which is when mistakes like these usually happen.

Sometimes, accidentally going into debt can be worth the brief moment of happiness. Of course, that would be before heading back to the store to return all those recent purchases.

The Classic Sob Story Scam

Well, having a venting session while sharing your emotions doesn't always have to be a scam- but when it ends with a request for some money, it's pretty close to being one. Whether it's your best friend or the family member who only comes around when they need something, you're probably used to the exchange at this point. In the end, always trust your gut, and if the story feels off- it probably is.

Whether their pet died, their car broke down, or they lost their job all in one week, chances are, that sad story could end in a request for some money.

When Charity Starts at Checkout

The cashier might have failed to look down at your purchase before asking you to make a donation to a good cause. Especially when you've put the cheapest candy in the store on the conveyor belt. Of course, it's hard to say no, and you might even feel a twinge of guilt after walking past that charity box. Maybe that candy bar will give you the energy you need to do something charitable without spending any cash.

Every little bit does count regarding any donation, but when you're about to sit down with nothing more than a single candy bar for dinner, there isn't much to spare.

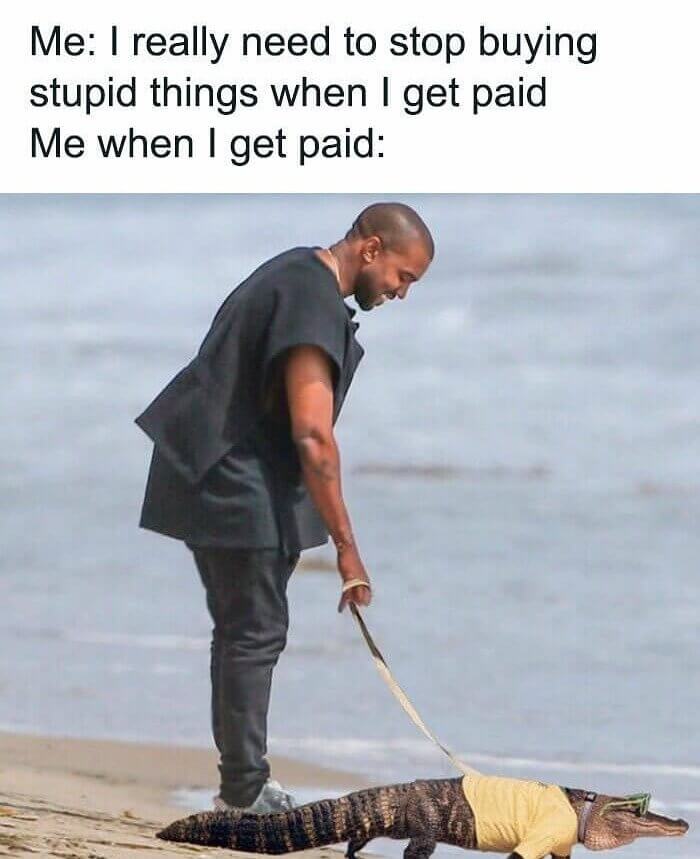

Paid Today, Broke Tomorrow- The Spending Cycle

There's no harm in splurging every once in a while, as long as you buy things that are either useful or bring at least temporary joy. It's hard to resist the temptation to swipe that card after receiving a fresh new paycheck from work, and you might have even sworn off purchasing for a while with a newfound dream of saving some cash. Often, that doesn't work out as you're sitting there justifying those ten recent purchases.

It's only natural to work hard, get your paycheck, and then feel like you deserve something special. Buying something is totally fine, as long as it's not an alligator with sunglasses.

Pocket Treasure Discoveries Are the Best

Some start to dream of all the purchases that could be made with the newfound pocket money wealth- and whether it's on hundred dollars or ten cents, it still counts. Suddenly, things start to feel a bit brighter because who doesn't love a surprise that involves a bit of cash? You might even start looking in all of your other pockets to keep the surprise trend going for the day.

There's a very specific type of joy that comes with finding money in your pocket that you had forgotten about; it just really is hard to explain the pure happiness.

The Cost of Being Endlessly Hungry

It's time for parents to face the facts- kids and teenagers alike are endlessly hungry. That means that they end up spending a lot of money that they're given on food, leaving every mom or dad wondering how that cash disappeared so quickly. From burritos to candy bars, the matter of the fact is that this isn't going to end anytime soon as they grow into even more hungry adults.

Parents asking where their kids' money went is an age-old question that has been asked for generations. They might even be convinced they're causing trouble, yet it all goes toward food.

When Light Is Scarier Than the Dark

While kids are afraid of the monsters under their best, we're more concerned about the electric bill that is sure to arrive at the end of the month. There's no doubt that adults would love to leave the light on and bask in the glow of a brightly lit room, but the truth is, electricity is just way too expensive these days- so it's best to remain in the dark.

Being an adult is also a constant battle between light, dark, comfort, and cost- and when someone else leaves a light on, well, there's nothing scarier than that very moment.