1944 - $3,500 - $59,872 When Adjusted for Inflation

In 1944, the average American home cost just $3,500, which translates to about $59,872 in today’s dollars when adjusted for inflation. At the time, the U.S. was still deeply involved in World War II, and the housing market was significantly impacted by material shortages and labor constraints. Many homes built during this period were modest, typically 800 to 1,200 square feet, featuring two to three bedrooms and simple designs.

Mortgage rates were relatively low, but purchasing a home was still a challenge due to wartime economic restrictions. With millions of men deployed overseas, housing construction slowed dramatically, leading to a post-war housing boom in the late 1940s as soldiers returned home.

1945 - $3,800 - $61,204 When Adjusted for Inflation

In 1945, the average American home cost $3,800, or about $61,204 when adjusted for inflation. With World War II coming to an end in September, the U.S. was on the brink of a massive economic shift. The housing market remained sluggish due to material rationing, but demand was starting to build as millions of returning soldiers sought homes. Most houses were modest, around 800 to 1,200 square feet, often featuring two bedrooms and a single bathroom.

The GI Bill, signed in 1944, was beginning to take effect, offering low-interest home loans to veterans. This set the stage for the post-war housing boom, which would reshape American suburbs in the coming decades.

1946 - $5,150 - $83,651 When Adjusted for Inflation

In 1946, the average American home cost $5,150, which equals about $83,651 today when adjusted for inflation. This year marked the beginning of a massive post-war housing boom, as millions of returning soldiers sought homes for their families. Demand skyrocketed, but housing supply struggled to keep up due to material shortages from World War II. To address this, developers began mass-producing affordable, single-family homes, leading to the rise of suburban communities like Levittown, New York.

These homes were typically 1,000 to 1,200 square feet, featuring two to three bedrooms and one bathroom. The GI Bill helped many veterans secure low-interest mortgages, fueling homeownership growth and setting the stage for America's suburban expansion.

1947 - $6,700 - $92,345 When Adjusted for Inflation

In 1947, the average American home cost $6,700, which equals about $92,345 in today’s dollars when adjusted for inflation. The post-war housing boom was in full swing, fueled by a strong economy and a surge in demand from returning veterans starting families. With millions of new buyers entering the market, developers focused on mass-producing affordable, single-family homes. The first Levittown—a model suburban community in New York—began construction, offering homes around 750 to 1,200 square feet, typically with two bedrooms, a single bathroom, and modern amenities like electric appliances.

The economy was thriving, but inflation was a concern, leading to rising construction costs and slightly higher home prices compared to previous years.

1948 - $7,700 - $96,872 When Adjusted for Inflation

In 1948, the average American home cost $7,700, or about $96,872 today when adjusted for inflation. The housing boom continued as suburban development expanded rapidly to meet growing demand. The economy was strong, and the GI Bill made homeownership more accessible for returning veterans, offering low-interest mortgages and minimal down payments. Houses built during this time were typically 800 to 1,200 square feet, with two to three bedrooms and a single bathroom, reflecting the needs of young, growing families.

Levittown, New York, was fully underway, pioneering mass-production housing techniques that allowed builders to construct entire neighborhoods at record speed. With the post-war baby boom in full swing, the American dream of homeownership was becoming a reality for millions.

1949 - $7,900 - $99,106 When Adjusted for Inflation

In 1949, the average American home cost $7,900, which equals about $99,106 today when adjusted for inflation. This year was pivotal for the housing market, as the Housing Act of 1949 was signed into law by President Harry Truman, aiming to provide “a decent home and a suitable living environment for every American family” by expanding federal funding for urban development and low-income housing. Meanwhile, the suburban boom continued, with mass-produced homes averaging 900 to 1,200 square feet, featuring two to three bedrooms, a single bathroom, and modern kitchen appliances.

Mortgage rates remained affordable, and homeownership was more accessible than ever, making the dream of owning a home in the suburbs a defining feature of post-war America.

1950 - $8,450 - $103,984 When Adjusted for Inflation

In 1950, the average American home cost $8,450, which equals about $103,984 today when adjusted for inflation. The post-war housing boom was still in full swing, with suburban expansion transforming the American landscape. Developers like William Levitt perfected the mass-production of homes, allowing for quick and affordable construction of single-family houses. These homes typically measured 1,000 to 1,200 square feet, featuring two to three bedrooms, a single bathroom, and a small yard—ideal for the growing number of families as the baby boom continued.

The economy was strong, wages were rising, and low-interest mortgage options made homeownership more attainable. With the rise of car culture and the expansion of highways, suburban living became the new American dream.

1951 - $9,000 - $107,823 When Adjusted for Inflation

In 1951, the average American home cost $9,000, which equals about $107,823 today when adjusted for inflation. The post-war economic boom was in full effect, and homeownership rates continued to climb as families flocked to newly developed suburban communities. Houses built during this period typically ranged from 1,000 to 1,300 square feet, featuring two to three bedrooms, a single bathroom, and modern appliances that reflected the growing influence of post-war consumerism.

The Federal Housing Administration (FHA) and the GI Bill made it easier for Americans, especially veterans, to secure low-interest mortgages. With an expanding middle class and rising wages, homeownership became an attainable goal for many, solidifying the suburban lifestyle as the new American standard.

1952 - $9,400 - $109,764 When Adjusted for Inflation

In 1952, the average American home cost $9,400, which equals about $109,764 today when adjusted for inflation. The post-war economic boom was still fueling the housing market, with suburban expansion continuing at a rapid pace. Houses built during this era typically measured 1,000 to 1,300 square feet, featuring two to three bedrooms, one bathroom, and increasingly modern kitchens equipped with electric appliances. The government-supported FHA and VA loans made homeownership more accessible, keeping mortgage rates low and demand high.

The rise of automobile ownership and expanding highway systems made commuting from the suburbs to city jobs easier, further encouraging suburban migration. With consumer confidence growing, the 1950s marked a golden age for the American housing market.

1953 - $9,600 - $110,482 When Adjusted for Inflation

In 1953, the average American home cost $9,600, which equals about $110,482 today when adjusted for inflation. The U.S. economy was thriving, with rising wages and a booming housing market driven by suburban expansion. Homes were typically 1,000 to 1,400 square feet, featuring two to three bedrooms, a single bathroom, and modern amenities like built-in kitchen appliances and central heating. The demand for affordable housing remained high, supported by FHA and VA loans, which provided low down payments and favorable mortgage rates.

The expansion of the interstate highway system made suburban commuting more practical, and the American dream of homeownership was more attainable than ever, solidifying suburbia as the preferred lifestyle for middle-class families.

1954 - $10,250 - $115,192 When Adjusted for Inflation

In 1954, the average American home cost $10,250, which equals about $115,192 today when adjusted for inflation. The U.S. housing market was thriving, with suburban development continuing to expand at a rapid pace. Homes were becoming slightly larger, typically 1,100 to 1,400 square feet, featuring three bedrooms, one bathroom, and modern conveniences like electric appliances and improved heating systems. The Federal Housing Administration (FHA) and Veterans Affairs (VA) loans played a key role in keeping mortgage rates low, making homeownership more accessible for the growing middle class.

As car ownership surged and interstate highways expanded, commuting from the suburbs to urban job centers became easier, further cementing the suburban lifestyle as the new American ideal.

1955 - $10,900 - $118,765 When Adjusted for Inflation

In 1955, the average American home cost $10,900, which equals about $118,765 today when adjusted for inflation. The housing market was booming, fueled by a strong post-war economy, rising wages, and the continued expansion of suburban developments. Homes were getting slightly larger, averaging 1,100 to 1,500 square feet, with three bedrooms, one bathroom, and modern amenities like built-in kitchen appliances and central heating. The Federal-Aid Highway Act was passed this year, laying the groundwork for the Interstate Highway System, which would make suburban commuting even more practical.

With government-backed loans still keeping mortgage rates low, homeownership became a reality for millions of families, further solidifying the era’s shift toward suburban living.

1956 - $11,300 - $122,934 When Adjusted for Inflation

In 1956, the average American home cost $11,300, which equals about $122,934 today when adjusted for inflation. The housing market remained strong, with suburban expansion continuing as demand for single-family homes surged. Typical houses were 1,200 to 1,500 square feet, featuring three bedrooms, one bathroom, and modern appliances like built-in ovens and refrigerators. This was also the year President Dwight D. Eisenhower signed the Federal-Aid Highway Act, launching the construction of the Interstate Highway System, which would revolutionize commuting and make suburban living even more convenient.

With low-interest government-backed loans still widely available, homeownership became increasingly attainable, reinforcing the growing trend of young families settling in suburban neighborhoods.

1957 - $12,220 - $125,849 When Adjusted for Inflation

In 1957, the average American home cost $12,220, which equals about $125,849 today when adjusted for inflation. The post-war economic boom was still in full effect, and suburban growth showed no signs of slowing down. Homes were typically 1,200 to 1,600 square feet, featuring three bedrooms, one bathroom, and modern kitchen appliances like dishwashers and electric stoves. The construction of the Interstate Highway System, which had begun the previous year, made suburban commuting even more practical, fueling further migration away from cities. Meanwhile, inflation was beginning to creep up, leading to slightly higher home prices.

Despite this, government-backed mortgages kept housing affordable for middle-class families, reinforcing the dream of suburban homeownership.

1958 - $12,750 - $127,682 When Adjusted for Inflation

In 1958, the average American home cost $12,750, which equals about $127,682 today when adjusted for inflation. The housing boom continued as suburban neighborhoods expanded, offering families affordable single-family homes averaging 1,200 to 1,600 square feet, with three bedrooms, one bathroom, and modern conveniences like dishwashers and television-friendly living rooms. The Interstate Highway System was under rapid development, making commutes from the suburbs to city jobs even easier. However, the U.S. economy hit a brief recession this year, causing a slowdown in home construction and higher unemployment.

Despite economic uncertainty, government-backed FHA and VA loans helped stabilize the housing market, allowing middle-class families to continue purchasing homes and fueling long-term suburban growth.

1959 - $13,400 - $130,974 When Adjusted for Inflation

In 1959, the average American home cost $13,400, which equals about $130,974 today when adjusted for inflation. The economy had rebounded from the previous year’s recession, and the housing market remained strong as suburban expansion continued. Typical homes were 1,300 to 1,700 square feet, featuring three bedrooms, one bathroom, and modern amenities like built-in kitchen appliances, larger living spaces, and attached garages. The ongoing construction of the Interstate Highway System made commuting from the suburbs more practical, further encouraging families to move away from crowded city centers.

Homeownership was still accessible thanks to low-interest FHA and VA loans, making the American dream of owning a house more achievable for middle-class families.

1960 - $14,000 - $134,812 When Adjusted for Inflation

In 1960, the average American home cost $14,000, which equals about $134,812 today when adjusted for inflation. The U.S. was entering a new decade of prosperity, and homeownership remained a cornerstone of the American dream. Houses were becoming slightly larger, averaging 1,400 to 1,800 square feet, with three bedrooms, one bathroom, and modern features like built-in kitchen appliances, central heating, and larger yards. The Interstate Highway System continued to expand, making suburban living even more attractive for middle-class families.

Mortgage rates remained relatively low, thanks to government-backed FHA and VA loans, helping more Americans buy homes. With rising wages and a strong economy, the 1960s would solidify suburban life as the ideal for many American families.

1961 - $14,500 - $138,405 When Adjusted for Inflation

In 1961, the average American home cost $14,500, which equals about $138,405 today when adjusted for inflation. Suburban expansion continued as families sought more space and modern conveniences, with typical homes averaging 1,400 to 1,800 square feet and featuring three bedrooms, one or one-and-a-half bathrooms, and upgraded kitchens with built-in appliances. The Interstate Highway System was making commuting easier, allowing workers to live farther from city centers. The economy remained strong, and homeownership was still widely accessible due to FHA and VA loans, which kept mortgage rates low.

As consumer confidence grew, new home designs incorporated larger living areas, carports or garages, and more modern heating and cooling systems, setting the stage for the evolving American suburb.

1962 - $15,200 - $142,963 When Adjusted for Inflation

In 1962, the average American home cost $15,200, which equals about $142,963 today when adjusted for inflation. The suburban boom was still in full swing, with developers building increasingly spacious homes averaging 1,500 to 1,900 square feet, featuring three bedrooms, one or two bathrooms, and modern amenities like central heating, larger kitchens, and attached garages. The economy was stable, and homeownership remained attainable thanks to low-interest FHA and VA loans, which helped families afford new homes. The Interstate Highway System was expanding rapidly, making suburban living even more convenient for commuters.

With a growing emphasis on modern design, homes in the early 1960s began featuring open floor plans, picture windows, and multi-purpose living spaces, reflecting the optimism of the era.

1963 - $16,000 - $148,234When Adjusted for Inflation

In 1963, the average American home cost $16,000, which equals about $148,234 today when adjusted for inflation. The U.S. economy was strong, and homeownership remained a key part of the American dream. Houses were becoming more spacious, averaging 1,600 to 2,000 square feet, with three bedrooms, one or two bathrooms, larger kitchens, and attached garages. The ongoing expansion of the Interstate Highway System made suburban living more accessible, allowing families to settle farther from city centers. Mortgage rates were still relatively low, thanks to FHA and VA loan programs, making it easier for middle-class families to buy homes.

Architectural trends in 1963 saw the rise of ranch-style and split-level homes, emphasizing open floor plans, large windows, and multi-purpose living areas, reflecting a shift toward more modern, family-friendly designs.

1964 - $17,000 - $155,001 When Adjusted for Inflation

In 1964, the average American home cost $17,000, which equals about $155,001 today when adjusted for inflation. The housing market remained strong as suburban expansion continued, with new home designs emphasizing comfort and convenience. Houses were growing in size, averaging 1,600 to 2,100 square feet, with three bedrooms, one or two bathrooms, spacious kitchens, and attached garages or carports. The Interstate Highway System made commuting easier, further encouraging families to move to the suburbs.

Mortgage rates remained affordable due to FHA and VA loan programs, making homeownership accessible to the growing middle class. Architectural trends continued to favor ranch-style and split-level homes, with open floor plans, large windows, and more integration between indoor and outdoor living spaces.

1965 - $17,900 - $161,328 When Adjusted for Inflation

In 1965, the average American home cost $17,900, which equals about $161,328 today when adjusted for inflation. The U.S. economy was thriving, and homeownership was still an attainable goal for middle-class families, thanks to low-interest FHA and VA loans. Houses continued to grow in size, averaging 1,700 to 2,200 square feet, with three or four bedrooms, one or two bathrooms, larger kitchens, and attached garages. The expansion of the Interstate Highway System made suburban living even more practical, allowing families to commute to city jobs with ease.

Ranch-style and split-level homes remained popular, featuring open floor plans, sliding glass doors leading to backyard patios, and modern conveniences like built-in dishwashers and central heating. With suburban life firmly established, developers continued building new communities to meet the increasing demand for single-family homes.

1966 - $18,200 - $165,726 When Adjusted for Inflation

In 1966, the average American home cost $18,200, which equals about $165,726 today when adjusted for inflation. The economy was strong, and homeownership remained within reach for many middle-class families, supported by FHA and VA loans that kept mortgage rates affordable. Houses were continuing to expand in size, averaging 1,800 to 2,300 square feet, featuring three or four bedrooms, one-and-a-half to two bathrooms, larger kitchens, and attached garages. The Interstate Highway System was making suburban living even more desirable, allowing homeowners to commute more easily to city jobs.

Ranch-style and split-level homes remained dominant, with open-concept living areas, sliding glass doors to backyard patios, and built-in modern appliances. With an increasing emphasis on suburban convenience, new shopping centers and schools were being developed alongside residential neighborhoods, reinforcing the appeal of suburban living.

1967 - $18,900 - $172,495 When Adjusted for Inflation

In 1967, the average American home cost $18,900, which equals about $172,495 today when adjusted for inflation. The U.S. economy was still strong, and homeownership remained a key part of the American dream, aided by FHA and VA loan programs that kept mortgage rates relatively low. Houses were continuing to increase in size, averaging 1,800 to 2,400 square feet, featuring three or four bedrooms, one-and-a-half to two bathrooms, larger kitchens, and attached garages or carports. The popularity of ranch-style and split-level homes persisted, with open floor plans, sliding glass doors, and family-friendly layouts.

Suburban expansion was in full swing, driven by the ongoing Interstate Highway System development, which made commuting more practical. Shopping malls, schools, and recreational facilities were being built alongside new residential communities, reinforcing the shift toward a suburban-centric lifestyle.

1968 - $19,900 - $180,932 When Adjusted for Inflation

In 1968, the average American home cost $19,900, which equals about $180,932 today when adjusted for inflation. The U.S. economy was strong, and homeownership was still attainable for many middle-class families, thanks to FHA and VA loans that kept mortgage rates reasonable. Houses were averaging 1,900 to 2,500 square feet, featuring three or four bedrooms, one-and-a-half to two bathrooms, attached garages, and spacious kitchens with modern appliances. The Fair Housing Act of 1968 was signed into law this year, prohibiting housing discrimination and increasing access to homeownership for more Americans.

Suburban expansion continued, driven by the growing Interstate Highway System, making commuting more convenient. Ranch-style and split-level homes remained the most popular designs, emphasizing open floor plans, large windows, and sliding doors leading to backyard patios, reflecting the desire for more indoor-outdoor living space.

1969 - $21,500 - $190,751 When Adjusted for Inflation

In 1969, the average American home cost $21,500, which equals about $190,751 today when adjusted for inflation. The economy was still strong, and homeownership remained a major goal for many middle-class families, aided by FHA and VA loans that kept mortgage rates relatively low. Houses were continuing to grow, averaging 2,000 to 2,600 square feet, with three or four bedrooms, one-and-a-half to two bathrooms, larger kitchens, and attached garages. The Fair Housing Act of 1968 was beginning to take effect, working to eliminate discriminatory housing practices and expand homeownership opportunities.

Suburban expansion showed no signs of slowing, fueled by the Interstate Highway System, which made commuting more convenient. Ranch-style and split-level homes remained dominant, with open floor plans, larger living areas, and sliding glass doors leading to patios, catering to the increasing demand for family-friendly layouts and outdoor space.

1970 - $23,400 - $198,236 When Adjusted for Inflation

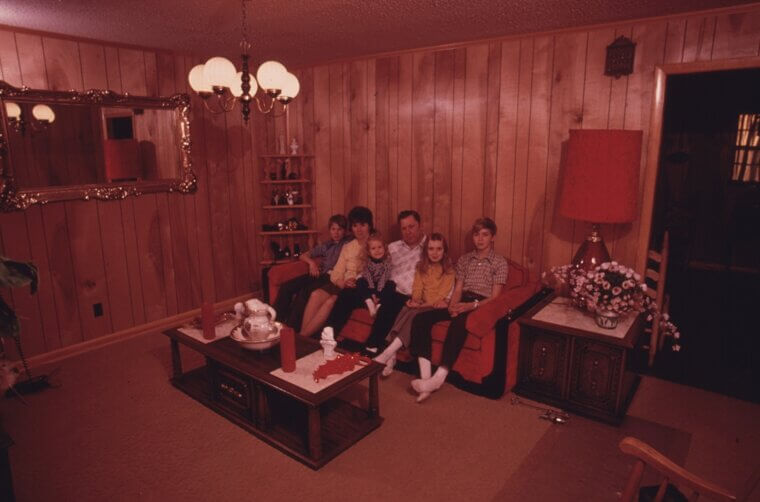

In 1970, the average American home cost $23,400, which equals about $198,236 today when adjusted for inflation. The economy was still expanding, but inflation was beginning to rise, affecting both wages and home prices. Suburban growth continued at a rapid pace, with newly constructed homes averaging 2,000 to 2,700 square feet, featuring three or four bedrooms, one-and-a-half to two bathrooms, larger kitchens, and attached garages or carports. Ranch-style and split-level homes were still the most popular, with open floor plans, sunken living rooms, and sliding glass doors leading to backyard patios.

The ongoing development of the Interstate Highway System made commuting from the suburbs easier, reinforcing the trend of families moving away from crowded city centers. Meanwhile, the impact of the Fair Housing Act of 1968 was starting to reshape housing policies, reducing discriminatory practices and expanding homeownership opportunities for more Americans.

1971 - $25,200 - $204,928 When Adjusted for Inflation

In 1971, the average American home cost $25,200, which equals about $204,928 today when adjusted for inflation. The U.S. economy was facing rising inflation, but homeownership remained attainable for many middle-class families, thanks to stable mortgage rates and government-backed loans. New homes were averaging 2,100 to 2,800 square feet, with three or four bedrooms, one-and-a-half to two bathrooms, and attached garages. Ranch-style and split-level homes remained popular, often featuring open-concept living areas, sunken family rooms, and large picture windows.

Suburban expansion continued as the Interstate Highway System made commuting more convenient. Meanwhile, President Richard Nixon took the U.S. off the gold standard this year, leading to economic uncertainty that would influence inflation and housing prices in the years to come.

1972 - $27,500 - $215,812 When Adjusted for Inflation

In 1972, the average American home cost $27,500, which equals about $215,812 today when adjusted for inflation. The economy was still growing, though inflation was becoming a concern, leading to rising home prices. Houses were averaging 2,200 to 2,900 square feet, featuring three or four bedrooms, one-and-a-half to two bathrooms, larger kitchens, and attached garages or carports. Ranch-style and split-level homes were still in high demand, incorporating open floor plans, sunken living rooms, and sliding glass doors leading to backyard patios.

The Interstate Highway System continued to expand, making suburban living more accessible. Homeownership remained a priority for many Americans, though rising interest rates were beginning to make mortgages slightly more expensive, foreshadowing economic challenges ahead.

1973 - $30,500 - $225,472 When Adjusted for Inflation

In 1973, the average American home cost $30,500, which equals about $225,472 today when adjusted for inflation. The U.S. economy was still expanding, but inflation was accelerating, largely due to the OPEC oil crisis that would soon send energy prices soaring. Homes continued to increase in size, averaging 2,300 to 3,000 square feet, featuring three or four bedrooms, two bathrooms, larger kitchens, and attached garages. Ranch-style and split-level homes remained the most popular, often incorporating open floor plans, sunken living rooms, and large windows for natural light.

The ongoing expansion of the Interstate Highway System allowed for further suburban growth, but economic uncertainty loomed as mortgage rates began to inch higher, signaling a shift that would affect home affordability in the coming years.

1974 - $32,000 - $232,682 When Adjusted for Inflation

In 1974, the average American home cost $32,000, which equals about $232,682 today when adjusted for inflation. The U.S. economy was experiencing turbulence as inflation soared due to the ongoing OPEC oil crisis, which led to rising fuel and construction costs. Mortgage rates began climbing, making homeownership more expensive. Despite these challenges, suburban growth continued, with homes averaging 2,300 to 3,100 square feet, featuring three or four bedrooms, two bathrooms, larger kitchens, and attached garages.

Ranch-style and split-level homes remained dominant, though some colonial and contemporary designs were gaining popularity. The economic downturn started to slow new home construction, and with stagflation setting in, the affordability of homes began to decline, marking the beginning of a more challenging housing market.

1975 - $35,500 - $245,482 When Adjusted for Inflation

In 1975, the average American home cost $35,500, which equals about $245,482 today when adjusted for inflation. The U.S. economy was struggling with stagflation, a combination of high inflation, slow economic growth, and rising unemployment. The OPEC oil crisis continued to drive up energy and construction costs, making homebuilding more expensive. Mortgage rates were rising, making it harder for some families to afford homeownership. Despite these challenges, suburban expansion persisted, with new homes averaging 2,300 to 3,200 square feet, featuring three or four bedrooms, two bathrooms, and larger kitchens with modern appliances.

While ranch-style and split-level homes remained common, there was growing interest in colonial and contemporary designs. With economic uncertainty looming, homebuyers were becoming more cautious, signaling a slowdown in the rapid growth of the housing market.

1976 - $38,600 - $255,994 When Adjusted for Inflation

In 1976, the average American home cost $38,600, which equals about $255,994 today when adjusted for inflation. The U.S. economy was still recovering from stagflation, but housing demand remained strong as inflation began to moderate. Mortgage rates were rising, making homeownership more expensive, but government-backed loans helped many families afford homes. New houses were averaging 2,400 to 3,300 square feet, featuring three or four bedrooms, two bathrooms, and attached garages. Ranch-style and split-level homes were still popular, but colonial and contemporary designs were becoming more desirable, often incorporating larger windows and open-concept layouts.

Suburban expansion continued, with new developments offering planned communities that included parks, schools, and shopping centers, reflecting a shift toward more self-sufficient suburban living.

1977 - $42,000 - $264,762 When Adjusted for Inflation

In 1977, the average American home cost $42,000, which equals about $264,762 today when adjusted for inflation. The economy was showing signs of improvement, but inflation and high mortgage rates were still making homeownership more expensive. Despite these challenges, suburban expansion continued, with newly built homes averaging 2,500 to 3,400 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and more energy-efficient designs due to rising energy costs.

Ranch-style homes remained common, but colonial and contemporary designs were becoming more sought after, incorporating larger windows, vaulted ceilings, and open floor plans. The growing popularity of planned communities, which included amenities like parks, schools, and shopping centers, reflected the increasing desire for convenience and self-contained suburban living.

1978 - $47,300 - $276,982 When Adjusted for Inflation

In 1978, the average American home cost $47,300, which equals about $276,982 today when adjusted for inflation. The economy was still grappling with high inflation and rising mortgage rates, making it more expensive to buy a home. Despite this, suburban development continued, with new homes averaging 2,500 to 3,500 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient features as builders responded to the ongoing energy crisis. Colonial and contemporary home designs were becoming increasingly popular, incorporating vaulted ceilings, skylights, and open floor plans, while traditional ranch-style homes remained a staple.

Planned communities with nearby schools, parks, and shopping centers were on the rise, reflecting a shift toward self-contained suburban neighborhoods. However, with mortgage rates climbing past 9%, affordability concerns were beginning to slow the housing market’s rapid growth.

1979 - $53,000 - $283,672 When Adjusted for Inflation

In 1979, the average American home cost $53,000, which equals about $283,672 today when adjusted for inflation. The housing market was facing serious challenges as inflation surged to nearly 14%, and mortgage rates soared past 11%, making homeownership increasingly expensive. Despite these financial pressures, suburban expansion continued, with newly built homes averaging 2,500 to 3,600 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient upgrades due to the ongoing energy crisis. Contemporary and colonial-style homes were growing in popularity, with open floor plans, high ceilings, and large windows.

Many homeowners were also installing solar panels and better insulation to combat rising utility costs. While demand for housing remained strong, the combination of skyrocketing mortgage rates and economic uncertainty foreshadowed a slowdown in the real estate market heading into the 1980s.

1980 - $58,700 - $295,924 When Adjusted for Inflation

In 1980, the average American home cost $58,700, which equals about $295,924 today when adjusted for inflation. The U.S. housing market faced major challenges as inflation peaked at 13.5%, and mortgage rates skyrocketed to nearly 16%, making homeownership more expensive than ever. High interest rates, driven by the Federal Reserve’s efforts to curb inflation, significantly reduced affordability, leading to a slowdown in home sales. Despite this, new suburban homes were still being built, averaging 2,600 to 3,700 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient upgrades in response to rising energy costs.

Contemporary and colonial-style homes remained popular, often including vaulted ceilings, skylights, and open-concept designs. The housing market was entering a period of volatility, with many potential buyers struggling to afford high monthly mortgage payments, setting the stage for a difficult decade ahead.

1981 - $62,200 - $301,895 When Adjusted for Inflation

In 1981, the average American home cost $62,200, which equals about $301,895 today when adjusted for inflation. The housing market was in crisis as mortgage rates hit a record high of nearly 18%, making it incredibly difficult for many buyers to afford a home. The Federal Reserve, under Chairman Paul Volcker, aggressively raised interest rates to combat runaway inflation, which remained above 10%. As a result, home sales plummeted, and many potential buyers were priced out of the market. Despite the economic turmoil, new homes continued to be built, averaging 2,600 to 3,800 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient designs to combat rising utility costs.

Colonial and contemporary homes remained in demand, often incorporating high ceilings, open floor plans, and large windows. However, with mortgage rates at record highs, many prospective buyers were forced to rent, leading to an increase in demand for apartments and rental properties.

1982 - $65,500 - $308,762 When Adjusted for Inflation

In 1982, the average American home cost $65,500, which equals about $308,762 today when adjusted for inflation. The housing market remained sluggish as mortgage rates peaked at a staggering 18.5%, making homeownership nearly unattainable for many Americans. The Federal Reserve's aggressive efforts to combat inflation led to a deep recession, causing home sales to plummet and new construction to slow significantly. Despite the economic downturn, newly built homes still averaged 2,600 to 3,800 square feet, featuring three or four bedrooms, two bathrooms, and attached garages.

Colonial and contemporary-style homes remained the most popular, with design elements like vaulted ceilings, skylights, and open-concept floor plans. Many buyers opted to rent instead of purchase, leading to increased demand for rental properties. By the end of the year, inflation was beginning to cool, offering hope for an eventual housing market recovery.

1983 - $68,500 - $316,234 When Adjusted for Inflation

In 1983, the average American home cost $68,500, which equals about $316,234 today when adjusted for inflation. After years of economic struggle, the housing market began to recover as inflation eased and mortgage rates, while still high, started to decline from their peak of over 18%. By the end of the year, interest rates had dropped to around 13%, making homeownership slightly more accessible. Newly built homes averaged 2,700 to 3,900 square feet, featuring three or four bedrooms, two bathrooms, and attached garages. Contemporary and colonial-style homes remained popular, incorporating cathedral ceilings, open floor plans, and large windows for natural light.

Energy-efficient upgrades, like better insulation and modern heating systems, became more common in response to high energy costs from the previous decade. While home sales were still slow, optimism was returning to the real estate market as the economy showed signs of sustained growth.

1984 - $72,400 - $324,825 When Adjusted for Inflation

In 1984, the average American home cost $72,400, which equals about $324,825 today when adjusted for inflation. The housing market was rebounding as inflation continued to decline, and mortgage rates, while still high, dropped to around 13% from their early-1980s peak of over 18%. The economy was growing, and consumer confidence was rising, leading to an increase in home sales. Newly constructed homes averaged 2,800 to 4,000 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and larger living spaces. Contemporary and colonial-style homes remained dominant, incorporating vaulted ceilings, open-concept designs, and energy-efficient upgrades like better insulation and modern heating systems.

With suburban development expanding rapidly, planned communities with shopping centers, schools, and parks became more common. While mortgage rates were still higher than in previous decades, the improving economy made homeownership more attainable, signaling a stronger real estate market ahead.

1985 - $75,500 - $333,982 When Adjusted for Inflation

In 1985, the average American home cost $75,500, which equals about $333,982 today when adjusted for inflation. The housing market was stabilizing, with mortgage rates dropping below 12% for the first time in years, making homeownership more affordable compared to the early 1980s. The economy was strong, and new construction was on the rise, with homes averaging 2,800 to 4,000 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and larger kitchens. Suburban expansion continued at a rapid pace, with planned communities featuring cul-de-sacs, neighborhood parks, and shopping centers. As consumer confidence grew, so did homeownership rates, signaling a full recovery from the housing downturn of the early 1980s.

Contemporary and colonial-style homes remained in demand, often incorporating vaulted ceilings, open floor plans, and energy-efficient appliances.

1986 - $82,200 - $344,892 When Adjusted for Inflation

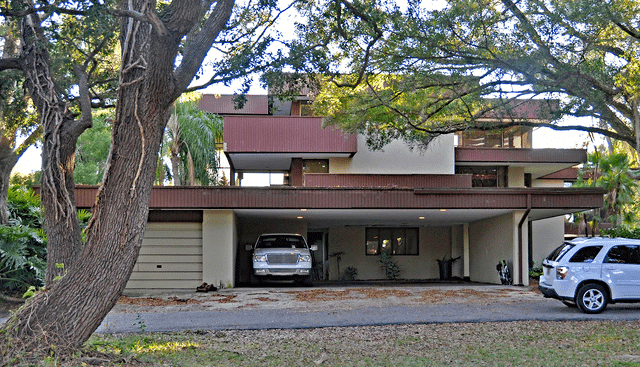

In 1986, the average American home cost $82,200, which equals about $344,892 today when adjusted for inflation. The housing market was booming, fueled by declining mortgage rates, which fell to around 10%, making homeownership more accessible. The economy was strong, and tax incentives, including the Tax Reform Act of 1986, encouraged real estate investment by providing benefits for homeowners and landlords. Newly built homes were averaging 2,900 to 4,100 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient designs. Contemporary and colonial-style homes were still dominant, incorporating vaulted ceilings, skylights, open-concept layouts, and modern kitchen appliances.

Suburban expansion accelerated, with master-planned communities offering amenities like shopping centers, golf courses, and recreational facilities. With confidence in the real estate market high, homeownership rates continued to climb, marking one of the most active housing markets of the decade.

1987 - $88,000 - $353,782 When Adjusted for Inflation

In 1987, the average American home cost $88,000, which equals about $353,782 today when adjusted for inflation. The housing market remained strong, driven by a growing economy and declining mortgage rates, which hovered around 9-10%, making homeownership more attainable compared to the early 1980s. Newly built homes were averaging 3,000 to 4,200 square feet, featuring three or four bedrooms, two bathrooms, attached garages, and energy-efficient upgrades such as better insulation and modern heating systems. Contemporary and colonial-style homes were still the most popular, with features like vaulted ceilings, open-concept layouts, and spacious kitchens. Suburban expansion continued, with more master-planned communities offering amenities like parks, golf courses, and shopping centers.

However, concerns about an overheated market began to surface, foreshadowing the stock market crash in October, which created some uncertainty about the future of the housing market.

1988 - $95,200 - $366,592 When Adjusted for Inflation

In 1988, the average American home cost $95,200, which equals about $366,592 today when adjusted for inflation. The housing market was still strong, though signs of slowing growth began to emerge as mortgage rates held steady around 9.5%. The economy remained healthy, and homeownership was still a priority for many families. Newly constructed homes averaged 3,000 to 4,300 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and larger kitchens with modern appliances. Contemporary and colonial-style homes remained dominant, often incorporating open floor plans, vaulted ceilings, and energy-efficient features. Suburban expansion continued, with developers focusing on master-planned communities that included parks, shopping centers, and recreational amenities.

While the market was still active, the effects of the 1987 stock market crash raised concerns about potential economic instability, causing some buyers to hesitate and home prices to increase at a slower rate than in previous years.

1989 - $98,000 - $375,762 When Adjusted for Inflation

In 1989, the average American home cost $98,000, which equals about $375,762 today when adjusted for inflation. The housing market remained active, though growth was beginning to slow as mortgage rates hovered around 10%, making homeownership slightly more expensive. The economy was still strong, but concerns about rising debt levels and inflation led to caution among homebuyers. Newly built homes averaged 3,000 to 4,400 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and updated kitchens with modern appliances. However, the rapid housing price increases of the 1980s were beginning to taper off, foreshadowing the economic downturn that would impact the housing market in the early 1990s.

Contemporary and colonial-style homes continued to dominate, with open floor plans, vaulted ceilings, and energy-efficient features. Suburban expansion persisted, with developers emphasizing master-planned communities that included parks, schools, and shopping centers.

1990 - $101,100 - $386,482 When Adjusted for Inflation

In 1990, the average American home cost $101,100, which equals about $386,482 today when adjusted for inflation. The housing market was beginning to cool, as mortgage rates remained around 10%, making homeownership less affordable for some buyers. The economy was showing signs of strain, with rising oil prices and a looming recession contributing to uncertainty. Newly built homes averaged 3,000 to 4,500 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and larger kitchens with updated appliances.

Contemporary and colonial-style homes were still the most popular, often incorporating open floor plans, vaulted ceilings, and energy-efficient designs. Suburban development continued, but the rapid price increases of the 1980s had slowed significantly. With the 1990-1991 recession on the horizon, some buyers hesitated to enter the market, and home sales began to decline, marking the start of a housing downturn that would last for several years.

1991 - $104,500 - $398,674 When Adjusted for Inflation

In 1991, the average American home cost $104,500, which equals about $398,674 today when adjusted for inflation. The housing market was in decline, as the U.S. entered a recession that led to job losses and economic uncertainty. Mortgage rates had fallen slightly to around 9.3%, but affordability remained a concern for many potential buyers. Home sales slowed, and price growth stagnated as fewer people were willing or able to purchase. Newly built homes averaged 3,000 to 4,500 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and updated kitchens with modern appliances.

Contemporary and colonial-style homes were still the most common, with open floor plans, vaulted ceilings, and energy-efficient improvements. Despite economic challenges, suburban expansion continued, but at a slower pace. The housing market faced higher foreclosure rates, and many homeowners saw their property values decline, marking the start of a sluggish period for real estate.

1992 - $107,900 - $410,325 When Adjusted for Inflation

In 1992, the average American home cost $107,900, which equals about $410,325 today when adjusted for inflation. The housing market was still sluggish, as the U.S. was recovering from the early 1990s recession, which had caused job losses and economic uncertainty. Mortgage rates had declined to around 8.4%, making homeownership more affordable, but many potential buyers remained cautious. Newly built homes averaged 3,100 to 4,600 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and updated kitchens with energy-efficient appliances. Home prices remained relatively stable, but sellers often had to make concessions to attract buyers. As the economy began to recover, there were signs of improvement in the housing market, setting the stage for future growth later in the decade.

Contemporary and colonial-style homes were still popular, with open floor plans, vaulted ceilings, and modern amenities. Suburban expansion continued, though at a slower pace, as developers adjusted to weaker demand.

1993 - $110,800 - $420,568 When Adjusted for Inflation

In 1993, the average American home cost $110,800, which equals about $420,568 today when adjusted for inflation. The housing market was starting to recover, as the economy rebounded from the early 1990s recession. Lower mortgage rates, which had dropped to around 7.3%, made homeownership more affordable, boosting buyer confidence and increasing home sales. Newly built homes averaged 3,100 to 4,700 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and upgraded kitchens with modern appliances. Suburban expansion picked up again, with new master-planned communities offering more amenities like shopping centers, parks, and schools.

While home prices were rising, they remained stable enough to encourage more first-time buyers to enter the market, signaling a renewed period of growth for real estate. Contemporary and colonial-style homes remained the most popular, incorporating open floor plans, vaulted ceilings, and energy-efficient features.

1994 - $113,500 - $430,972 When Adjusted for Inflation

In 1994, the average American home cost $113,500, which equals about $430,972 today when adjusted for inflation. The housing market was gaining momentum, driven by a growing economy and continued low mortgage rates, which hovered around 7%. Home sales increased as more buyers re-entered the market, taking advantage of improved affordability. Newly built homes averaged 3,200 to 4,800 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient appliances. Contemporary and colonial-style homes remained the most common, incorporating open floor plans, high ceilings, and modern kitchen designs. Suburban expansion accelerated as developers focused on master-planned communities with amenities like shopping centers, parks, and schools.

While home prices were rising steadily, they remained within reach for many middle-class families, contributing to a period of sustained growth in the real estate market throughout the mid-1990s.

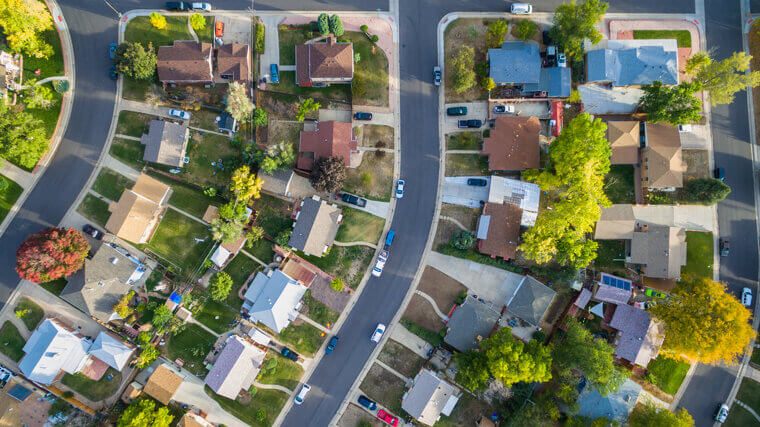

1995 - $117,000 - $444,726 When Adjusted for Inflation

In 1995, the average American home cost $117,000, which equals about $444,726 today when adjusted for inflation. The housing market was thriving, fueled by a strong economy, steady job growth, and relatively low mortgage rates of around 7.9%. Home sales increased as more first-time buyers and move-up buyers entered the market. Newly built homes averaged 3,200 to 4,900 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient designs. Contemporary and colonial-style homes remained the most popular, often incorporating vaulted ceilings, open floor plans, and larger kitchens with modern appliances.

Suburban development was booming, with many new master-planned communities offering schools, shopping centers, and recreational facilities. The combination of rising wages and stable housing prices made homeownership more accessible, contributing to a period of continued real estate growth that would last through the late 1990s.

1996 - $120,500 - $456,482 When Adjusted for Inflation

In 1996, the average American home cost $120,500, which equals about $456,482 today when adjusted for inflation. The housing market was on an upswing, driven by a strong economy, rising wages, and mortgage rates that remained stable around 7.8%. Home sales continued to grow as affordability remained within reach for many middle-class families. Newly built homes averaged 3,300 to 5,000 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient upgrades like improved insulation and modern HVAC systems. Contemporary and colonial-style homes dominated the market, with features like open floor plans, high ceilings, and spacious kitchens with islands.

Suburban expansion surged as homebuyers sought out master-planned communities that offered amenities such as parks, schools, and shopping centers. With confidence in the economy and real estate market increasing, home prices saw steady growth, setting the stage for a housing boom in the late 1990s.

1997 - $124,100 - $467,892 When Adjusted for Inflation

In 1997, the average American home cost $124,100, which equals about $467,892 today when adjusted for inflation. The housing market was booming, fueled by a strong economy, low unemployment, and mortgage rates that dipped to around 7.6%, making homeownership more affordable. Demand for homes increased, and prices continued to rise steadily. Newly built homes averaged 3,400 to 5,100 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient designs. Contemporary and colonial-style homes remained the most popular, incorporating open floor plans, vaulted ceilings, and larger kitchens with islands and modern appliances. The expansion of master-planned communities surged, offering convenient access to schools, parks, and shopping centers.

As more buyers entered the market, competition for homes increased, driving up prices and reinforcing confidence in real estate as a solid investment heading into the late 1990s housing boom.

1998 - $129,300 - $478,295 When Adjusted for Inflation

In 1998, the average American home cost $129,300, which equals about $478,295 today when adjusted for inflation. The housing market was thriving, driven by a booming economy, stock market gains, and mortgage rates that had dropped to around 6.9%, making homeownership more affordable. Demand for homes surged, and prices continued their steady rise. Newly built homes averaged 3,500 to 5,200 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient upgrades like improved insulation and HVAC systems. The rise of technology and home internet access also influenced home designs, with more buyers looking for built-in office spaces.

Master-planned communities expanded, offering amenities such as parks, walking trails, and shopping centers. With strong economic confidence and increasing home values, real estate was seen as an excellent long-term investment heading into the late 1990s housing boom.

1999 - $133,500 - $487,782 When Adjusted for Inflation

In 1999, the average American home cost $133,500, which equals about $487,782 today when adjusted for inflation. The housing market was booming, fueled by a strong economy, rising wages, and mortgage rates that had dropped to around 6.9%, keeping homeownership affordable for many buyers. Newly built homes averaged 3,600 to 5,300 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient designs with upgraded heating and cooling systems. Master-planned communities were expanding, offering suburban buyers amenities such as shopping centers, parks, and top-rated schools.

With the dot-com boom in full swing, real estate was seen as a lucrative investment, and home values continued their steady climb, setting the stage for the rapid housing market growth of the early 2000s.

2000 - $139,000 - $498,234 When Adjusted for Inflation

In 2000, the average American home cost $139,000, which equals about $498,234 today when adjusted for inflation. The housing market was thriving, supported by a strong economy, rising wages, and mortgage rates around 8%, which were still relatively affordable for buyers. Demand for homes remained high, and new construction focused on larger homes averaging 3,700 to 5,400 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and modern energy-efficient upgrades. With the dot-com boom at its peak, many homebuyers saw real estate as a reliable long-term investment, and property values continued their steady rise.

However, with economic uncertainty looming due to stock market volatility, the rapid appreciation of home prices hinted at challenges ahead in the housing market. Master-planned suburban communities continued to expand, offering residents easy access to shopping centers, schools, and recreational facilities.

2001 - $146,200 - $512,762 When Adjusted for Inflation

In 2001, the average American home cost $146,200, which equals about $512,762 today when adjusted for inflation. The housing market remained strong, though economic uncertainty was rising due to the dot-com bubble burst and the September 11 attacks, which shook consumer confidence. Despite these concerns, mortgage rates dropped to around 7%, keeping homeownership affordable and fueling continued demand. Newly built homes averaged 3,800 to 5,500 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and modern energy-efficient upgrades. Master-planned suburban communities continued expanding, offering amenities such as shopping centers, parks, and high-quality schools.

While the real estate market was still growing, the economy was showing signs of strain, and the Federal Reserve cut interest rates multiple times, setting the stage for an era of low borrowing costs that would drive housing demand in the coming years.

2002 - $157,200 - $529,482 When Adjusted for Inflation

In 2002, the average American home cost $157,200, which equals about $529,482 today when adjusted for inflation. The housing market was heating up, fueled by historically low mortgage rates, which had dropped to around 6.5%, making homeownership more affordable. The Federal Reserve's interest rate cuts in response to the 2001 recession and the dot-com crash encouraged borrowing, leading to increased home sales. Newly built homes averaged 3,900 to 5,600 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and modern energy-efficient designs.

Master-planned suburban communities continued to expand, with new developments offering amenities such as clubhouses, walking trails, and gated security. With home values rising steadily and mortgage lending becoming more relaxed, many buyers saw real estate as a prime investment, laying the groundwork for what would soon become a full-fledged housing bubble.

2003 - $168,000 - $548,762 When Adjusted for Inflation

In 2003, the average American home cost $168,000, which equals about $548,762 today when adjusted for inflation. The housing market was booming, driven by historically low mortgage rates around 5.8%, making homeownership more affordable than ever. The Federal Reserve’s low interest rate policies and increasingly relaxed lending standards encouraged more buyers to enter the market, fueling rapid price appreciation. Newly built homes averaged 4,000 to 5,700 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient designs. Contemporary and colonial-style homes remained dominant, often incorporating open floor plans, larger kitchens with islands, vaulted ceilings, and dedicated home offices. Master-planned communities with amenities like pools, fitness centers, and gated security became increasingly popular.

Investors and speculators saw real estate as a lucrative opportunity, leading to increased home flipping and a surge in demand. With lending standards loosening—offering adjustable-rate mortgages (ARMs) and no-money-down loans—the housing bubble was inflating rapidly, setting the stage for future instability in the real estate market.

2004 - $184,100 - $572,325 When Adjusted for Inflation

In 2004, the average American home cost $184,100, which equals about $572,325 today when adjusted for inflation. The housing market was red-hot, fueled by historically low mortgage rates around 5.3% and increasingly lax lending standards, making it easier than ever to buy a home. Banks and mortgage lenders offered adjustable-rate mortgages (ARMs), interest-only loans, and no-money-down options, allowing buyers to purchase more expensive homes than they could traditionally afford. Newly built homes averaged 4,100 to 5,800 square feet, featuring three or four bedrooms, two or more bathrooms, attached garages, and energy-efficient upgrades. Contemporary and colonial-style homes remained the most popular, with open floor plans, expansive kitchens with islands, vaulted ceilings, and luxury amenities like home theaters and spa-like bathrooms.

Master-planned communities continued to expand, offering buyers resort-style pools, fitness centers, and gated security. Investors and house flippers flooded the market, driving up home prices rapidly. With little oversight in mortgage lending and speculative buying at an all-time high, the foundations for the housing bubble were fully in place, leading to the eventual financial crisis just a few years later.